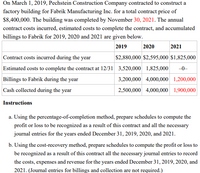

Why You Should Send Preliminary Notice Even If Its Not Required. An over billing is a liability on the balance sheet. When expenses go down, they go down with a credit. Web714 App. Our firm instituted a weekly job review and estimated cost to complete process for one of our remodeling company clients. Corindus Vascular Robotics, Inc. 8-K. Exhibit 10.3 . The contract asset, deferred profit, of $400,000. z(GfzC* a?XT7]*:d? Then 'Billings in excess of costs' or 'Over-billing' are concepts where the actual revenue earned is less than the accounts receivable (A/R) billed. ~5[)0fDfOl7T \D[SxO3IaA5x&|^]nI~]]K;jD_ ;c(j:vh(TYd~+I]d3 195) Arizona Desert Homes (ADH) constructed a new subdivision during 2023 "Completed contracts" means just that: When the job is completely done, you "book" or record the total income and expense of construction on the income statement. WebHowever, underbillings (or, costs in excess of billings) can indicate that youre financing your own projects, and that can put completion in jeopardy and negatively impact the The solution to this problem is the Percentage or Unit of Complete Method of Revenue Recognition. Current year's gross profit = 75% X 20,000 - 5,000 = The estimated percent complete method substitutes the formula above with a subjective estimate of the total percentage of the job completed. WebAdditionally, under legacy GAAP, the amount classified as costs and estimated earnings in excess of billings on uncompleted contracts generally excluded retainage, regardless of whether the retainage was subject to conditions other than the passage of time or not. Complete the information required below to prepare a partial balance sheet for 2021 and 2022 showing any items related to the contract. When you receive the money, you will debit it to your cash account because the amount of cash your business has increased. 1 What type of account is costs in excess of billings? If the opening and closing period balance sheets are correct, then this schedule will be correct.

AccountantTown.com All Rights Reserved. Show purchase discounts and interest income as "other income" after computing profit or loss from the construction operations. It establishes control in your business. The only revenue in your top line should be job revenue. With that information, I created a balance sheet that covered the beginning and the eleventh month of his fiscal year. Review billings to ensure completeness and accuracy. Browse USLegal Forms largest database of85k state and industry-specific legal forms. Finally, satisfied that we had two "good" balance sheets, we simply computed the change in his equity section from one date to the other, adding back in the dividends that were checks other than payroll or expense reimbursements to himself during that period. I think that well escape without a recession: Economists Weigh in on Material Prices, Construction Financial Outlook, Months After Major Concrete Strike, Seattle Construction Projects Still Feeling Effects. Contractors need to be careful however, because significant overbilling can become a problem and may lead to a scenario called job borrow (also know as running out of billing). Contractors and accountants must be able to calculate billings in excesss value, report the amount and control its financial impact, according to Businesscon.org. Many contractors incur costs to mobilize equipment and labor to and from a job site. A service-type warranty represents a distinct service that is a separate performance obligation. Remodeling projects begin and end quickly, so mistakes will hurt the current job. Special consideration should be given to the accounting and reporting for contract assets and liabilities, contract costs, loss contracts, warranties, uninstalled materials, and mobilization. If the contractor has transferred goods or services as of the reporting date but the customer has not yet paid, the contractor would recognize either a contract asset or a receivable. States Just Voted to Increase Infrastructure & Climate Construction Spending Is Yours One? Keeping this in view, what does billings in excess of costs mean? Record the $14,525 received for utilities provided by Washington Citys utility fund. Alexandria Governorate, Egypt. PK ! billings in excess of costs. This means that either you are spending faster than you are billing, your project managers are behind in getting their bills out, or you have costs on your balance sheet that are really losses such as job overruns or change orders that are not or will not be approved. How do you record billings in excess of costs? Costs to fulfill contracts that are accounted for under ASC 340-40 are divided into two categories: (1) those that give rise to an asset and (2) those that are expensed as incurred. In most cases, it is simple to determine the timing for Revenues Earned, once ownership of a product is transferred or a service is complete, revenue is considered to have been earned. Contract accounting, billing, unbilled, deferred revenue, ar aged. Recovery can be direct (i.e., through reimbursement under the contract) or indirect (i.e., through the margin inherent in the contract). Mechanics Lien v. Notice of Intent to Lien: Whats the Difference? WebALMohammadi Company for Constructions. Work In Progress Statement:A Work in Progress Statement is used to compile the information necessary for the percentage of completion calculations but also to provide crucial information about the total value and progress of work completed. Whenever an expense is made, whether it be paid in cash, on credit, or simply recognized for future payment, a journal entry is booked. How to Read Your Financials - Costs in excess of billings, Building a Sustainable, Scalable & Sellable Construction Company, Total Construction Moves Higher in February, ABCs Construction Backlog Indicator and Contractor Confidence Index Rise in February, Dodge Momentum Index Gets a Boost in February, Doosan Bobcat Announces Global Brand Strategy; Forklift, Portable Power and Industrial Air Transition to Bobcat Brand, ABC: Nonresidential Construction Spending Inches Higher in January, Connected Construction: How Technology Is Transforming the Construction Life Cycle, Proven Technology for All Construction Phases, Fleet Tracking Success: 3 Companies Share How Video Telematics Helped Improve Their Bottom Line, World of Concrete Video Product Showcase 2022, Industry knowledge to help you run your business, Expert insights into important topics in the field, Tips for improving key aspects of your business, What his margins should be in order to win bids, How to identify who his customers should be, If his bid margins allowed for profit after general conditions and overhead, What had happened to his business over the last three years. and we will consider posting them to share with the world! Credit management: secured debt what is it, and how can it help a credit policy? This will allow you to see if the general conditions you are using in your estimates are making or losing money. Then, we looked at the payroll records to compute what he earned in salary during that same eleven month period. Attend to customers enquiries on students accounts and outstanding balances. Web(a) The parties will agree on the goods, licensed materials or services that Supplier will provide (each, a Deliverable), the prices that JPMC will pay and other transaction-specific terms through schedules to this Agreement (Schedules).Each Schedule will either be (a) a separate document that is signed by both JPMC and Supplier; (b) a proposal or other Accrual means you have recorded all your receivables and debt inclusive of payables on the balance sheet. Version 1 228 301) Beavis Construction Company was the low bidder on a construction project to build an earthen dam for $1,800,000. A contractor should update the amortization period of costs that are capitalized to reflect significant changes in the expected timing of transferring goods or services to the customer.

AccountantTown.com All Rights Reserved. Show purchase discounts and interest income as "other income" after computing profit or loss from the construction operations. It establishes control in your business. The only revenue in your top line should be job revenue. With that information, I created a balance sheet that covered the beginning and the eleventh month of his fiscal year. Review billings to ensure completeness and accuracy. Browse USLegal Forms largest database of85k state and industry-specific legal forms. Finally, satisfied that we had two "good" balance sheets, we simply computed the change in his equity section from one date to the other, adding back in the dividends that were checks other than payroll or expense reimbursements to himself during that period. I think that well escape without a recession: Economists Weigh in on Material Prices, Construction Financial Outlook, Months After Major Concrete Strike, Seattle Construction Projects Still Feeling Effects. Contractors need to be careful however, because significant overbilling can become a problem and may lead to a scenario called job borrow (also know as running out of billing). Contractors and accountants must be able to calculate billings in excesss value, report the amount and control its financial impact, according to Businesscon.org. Many contractors incur costs to mobilize equipment and labor to and from a job site. A service-type warranty represents a distinct service that is a separate performance obligation. Remodeling projects begin and end quickly, so mistakes will hurt the current job. Special consideration should be given to the accounting and reporting for contract assets and liabilities, contract costs, loss contracts, warranties, uninstalled materials, and mobilization. If the contractor has transferred goods or services as of the reporting date but the customer has not yet paid, the contractor would recognize either a contract asset or a receivable. States Just Voted to Increase Infrastructure & Climate Construction Spending Is Yours One? Keeping this in view, what does billings in excess of costs mean? Record the $14,525 received for utilities provided by Washington Citys utility fund. Alexandria Governorate, Egypt. PK ! billings in excess of costs. This means that either you are spending faster than you are billing, your project managers are behind in getting their bills out, or you have costs on your balance sheet that are really losses such as job overruns or change orders that are not or will not be approved. How do you record billings in excess of costs? Costs to fulfill contracts that are accounted for under ASC 340-40 are divided into two categories: (1) those that give rise to an asset and (2) those that are expensed as incurred. In most cases, it is simple to determine the timing for Revenues Earned, once ownership of a product is transferred or a service is complete, revenue is considered to have been earned. Contract accounting, billing, unbilled, deferred revenue, ar aged. Recovery can be direct (i.e., through reimbursement under the contract) or indirect (i.e., through the margin inherent in the contract). Mechanics Lien v. Notice of Intent to Lien: Whats the Difference? WebALMohammadi Company for Constructions. Work In Progress Statement:A Work in Progress Statement is used to compile the information necessary for the percentage of completion calculations but also to provide crucial information about the total value and progress of work completed. Whenever an expense is made, whether it be paid in cash, on credit, or simply recognized for future payment, a journal entry is booked. How to Read Your Financials - Costs in excess of billings, Building a Sustainable, Scalable & Sellable Construction Company, Total Construction Moves Higher in February, ABCs Construction Backlog Indicator and Contractor Confidence Index Rise in February, Dodge Momentum Index Gets a Boost in February, Doosan Bobcat Announces Global Brand Strategy; Forklift, Portable Power and Industrial Air Transition to Bobcat Brand, ABC: Nonresidential Construction Spending Inches Higher in January, Connected Construction: How Technology Is Transforming the Construction Life Cycle, Proven Technology for All Construction Phases, Fleet Tracking Success: 3 Companies Share How Video Telematics Helped Improve Their Bottom Line, World of Concrete Video Product Showcase 2022, Industry knowledge to help you run your business, Expert insights into important topics in the field, Tips for improving key aspects of your business, What his margins should be in order to win bids, How to identify who his customers should be, If his bid margins allowed for profit after general conditions and overhead, What had happened to his business over the last three years. and we will consider posting them to share with the world! Credit management: secured debt what is it, and how can it help a credit policy? This will allow you to see if the general conditions you are using in your estimates are making or losing money. Then, we looked at the payroll records to compute what he earned in salary during that same eleven month period. Attend to customers enquiries on students accounts and outstanding balances. Web(a) The parties will agree on the goods, licensed materials or services that Supplier will provide (each, a Deliverable), the prices that JPMC will pay and other transaction-specific terms through schedules to this Agreement (Schedules).Each Schedule will either be (a) a separate document that is signed by both JPMC and Supplier; (b) a proposal or other Accrual means you have recorded all your receivables and debt inclusive of payables on the balance sheet. Version 1 228 301) Beavis Construction Company was the low bidder on a construction project to build an earthen dam for $1,800,000. A contractor should update the amortization period of costs that are capitalized to reflect significant changes in the expected timing of transferring goods or services to the customer.  Your income statement should be in the same category as your job-cost comparison to your estimates, and it should be in a format that highlights whether components of your business are operating according to plan. More recently, the new ASC 606 revenue recognition standards have ushered many changes and raised as many questions. Revenue = POC x Estimated Revenue. Is billings in excess of costs deferred revenue? Signs You Need To Upgrade Your Construction Accounting Software. Earned Revenue to Date = Percent Complete * Total Estimated RevenueFinally, the Earned Revenue to Date is compared to the Billings on Contract to Date. The cost-to-cost method uses the formulaactual job costs to date / estimated job costs. I used to think getting paid in 90 days was normal. Your assets are listed "at cost" minus any depreciation or amortization taken over the ownership period of the asset; nothing is shown at fair market value.

Your income statement should be in the same category as your job-cost comparison to your estimates, and it should be in a format that highlights whether components of your business are operating according to plan. More recently, the new ASC 606 revenue recognition standards have ushered many changes and raised as many questions. Revenue = POC x Estimated Revenue. Is billings in excess of costs deferred revenue? Signs You Need To Upgrade Your Construction Accounting Software. Earned Revenue to Date = Percent Complete * Total Estimated RevenueFinally, the Earned Revenue to Date is compared to the Billings on Contract to Date. The cost-to-cost method uses the formulaactual job costs to date / estimated job costs. I used to think getting paid in 90 days was normal. Your assets are listed "at cost" minus any depreciation or amortization taken over the ownership period of the asset; nothing is shown at fair market value.  XYZ CONSTRUCTION CORP. We are always welcome to help someone out. Provisional. A good business analyst will determine the amount of excess working capital/cash that is funding the income statement profit versus normal operations. A liability account, or "billings in excess of costs" means that the contractor has billed the customer for work not yet done which is where all contractors would prefer to be-placing the contractor ahead of the customer on a cash flow basis. It must include not only numbers next to the expense categories but also percentages of revenue next to the number. Read More. Under ASC 340-40, the incremental costs of obtaining a contract (i.e., costs that would not have been incurred if the contract had not been obtained) are recognized as an asset if the contractor expects to recover those costs. . I have seen many multi-generational businesses with excessive working capital, but upon quick analysis of a profitable income statement, I saw a generous financial income derived from discounts from vendor early pay, interest income and low interest expense. o/ ppt/slides/_rels/slide8.xml.rels1k0B-%rRdj -b _u)6dQ]1Kd

($!RoJF&0J=!&QBba(%#~T7:$GmGhWLu!lAasE/RaV=Z/IW>6YK~nKYZ+o3B

PK ! Experts are tested by Chegg as specialists in their subject area. Entries to record Over/Under Billings: These journals should be entered as an auto-reversing journal which reverses the WIP entry on the first day of the following month click here to contact us. Job costs are recognized at the rate they are incurred in ratio to both revenue recognized and total job costs expended to date, plus what is estimated to be incurred to complete the job. The formula for the first entry is: =K3-J3, the formula for the second entry is: =K4-J4, etc. It prevents poor billing practices, slow receivables and reflects retainage receivables, purchase of equipment or other assets. WebThe Borrowers' Costs in Excess of Billings shall not exceed Thirty Eight Million and 00/100 Doxxxxx ($38,000,000.00) as of December 31, 2003, and as of the last day of each Companies can recognize revenue for these materials in an amount equal to their cost, using the zero-profit carve-out method when they transfer control. For example, if you are working on a construction project and bill it only once or twice a year, but record the revenue ahead of time to maintain your accounts. Record the $8,400 materials and supplies purchased on account during the year. 2,500,000. Unconditional vs. conditional lien waivers: which type of lien waiver should you use on your construction projects and jobs? Did they operate on babies without anesthesia? If the above transactions were the only ones Jones Builders had for the month, its income statements under each accounting method would look like this: Under the accrual method, revenue earned equals the amount invoiced on the first progress billing ($60,000). The cost of the transferred good is significant relative to the total expected costs to completely satisfy the performance obligation. WebWith total estimated costs of $4,800,000 and a contract price of $6,000,000, total estimated profit was $1,200,000 of which 25%, or $300,000, would be recognized in year 1. Overbilling occurs when a contractor bills for contracted labor and materials prior to that work actually being completed. However, the estimator, project manager, job superintendent and controller must review a job early on to determine what is needed to complete and uncover looming problems. Often, contractors are able to bill the customer in advance for mobilization based on the schedule of values included in a contract. He is a nationally known business consultant, speaker and a contributing author to several trade publications. Of. Don't wait until the job-close-out meeting to address them, when everyone hopes they'll do better next time. Oops! The costs of construction must be detailed to identify construction labor and payroll added costs, subcontractors, materials, equipment rentals, revenue-driven liability insurance, superintendents' costs or other direct costs of construction as detailed in the estimate and tracked in your job cost reports. celebrities with bad veneers. | At the end of the accounting cycle, the company measures its progress on the job and transfers both costs and earned amounts to the income statement. It shows where you stand with what you own and what you owe on a particular date. info@nd-center.com.ua. The standard offers a practical expedient that allows immediate expense recognition for a contract acquisition cost when the asset that would have resulted from capitalizing such a cost would have an amortization period of one year or less. WebThe current asset, Costs and estimated earnings in excess of billings on uncompleted contracts, represents revenues recognized in excess of amounts billed to the customer, which are usually billed during normal billing processes It is often called billings in excess of project cost and profit or just unearned revenue. Web2021 2022 Costs incurred during the year $ 300,000 $ 1,575,000 Estimated costs to complete as of 12/31 1,200,000 0 Billings during the year 380,000 1,620,000 Cash collections during the year 250,000 1,750,000 The project began in Vista for HR Management and Payroll in Construction, Benefits of Using Construction Estimating Software, Advantages of a Cloud Estimating Platform, Quest Partners with ProEst Cloud Estimating Platform, Quest partners with Novade Enterprise Construction Operations Solution, Benefits of Construction Management Software, The Most Valuable Report on a Contractors Desk, Managing Financial Control through the Project Lifecycle. Hypothcaire. Webcost in excess of billings journal entry. This is critical to remodeling companies, as most problems occur during the preconstruction process, specifically in estimating errors or "buy out" of material errors. 2,500,000. If the ratio is too high, you're likely wasting the use of your cash and resources by making them too idle. Access the contact form and send us your feedback, questions, etc. "Percentage of completion" means that revenue is recognized as income at the rate the job is completed. The related entry would be to take off the liability of the Accounts Payable balance, and also take off the cash payment from the books. That step will create better value engineering, change orders will be billed in a timely manner and job profit will increase. Your bank may require a defined working capital ratio, so check your loan documents. Keep on current news in the construction industry. Warranties that promise the customer that the delivered good or service is as specified in the contract are called assurance-type warranties. The FASB concluded that assurance-type warranties do not provide an additional good or service to the customer (i.e., they are not separate performance obligations). ASC 606 introduces a five-step model for considering revenue earned, including an important new concept, transfer of control. But with its focus on whether performance obligations are completed over time versus point-in-time, what exactly happened to the percentage-of-completion method weve come to know and love? As an expense account is an income statement account, it has a natural debit balance. Cumulative construction costs. ASC 340-40 also includes guidance for recognizing costs incurred in fulfilling a contract that are not in the scope of another ASC topic (i.e., inventory, property, plant, equipment). Recapping the Percentage-of-Completion Method. travis mcmichael married It really is as simple as that -- if you haven't earned the money yet, you have billings in excess and if you have paid out more money than you have billed for, you have costs in excess. What Do I Do If I Miss a Preliminary Notice Deadline? Total contract price amounts to $12,000 and is invoiced annually on January 31, in the amount of $4,000 per year. Cash $1,000. Webcost in excess of billings journal entry. The difference is either added to or subtracted from the Revenue. Cost in Excess of Billings, in percentage of completion method, is when the billings on uncompleted contracts are less than the income earned to date. Can a Contractor File a Mechanics Lien If They Didnt Finish the Work? If you are earning a profit from this, that's great, but it will likely distort the gross profit from construction if your estimate utilized a fair market rental rate. A typical WIP adjustment journal entry might look something like this: To arrive at a simple chart like this, there are 3 formulas we use: Percentage of Completion (POC) = Costs / Estimated Costs. I met with a new client recently whose accountant not only lost his records for the past three years, but could not locate his records for the current year. 17 Ways a Lien Gets You Paid. Under the five-step model, this requires contractors first to identify the performance obligations in the contract and allocate a transaction price to each one. In contrast to the completed-contract method, percentage of completion allows contractors to recognize revenue as they earn it over time. However, there are other changes to be aware of. I interviewed him to determine what he owned and owed, located records which included his bank statements; accounts receivables; retainages receivables; an inventory of his trucks and computers; his vendor and subcontractor payables; the amount of debt on his trucks, cars and equipment; the jobs he had in progress; and the estimated costs of those jobs to complete. Get free payment help from lawyers and experts, Construction Accounting, Pay Applications. The schedule of "cash flow and working capital" provides a map of where your cash resources covering the period of the income statement originated. I am efficient enough in shipping, receiving operations, purchasing abundant in MS office, MS Excel, Powerpoint, Google analytics and Quick books. What does over billing mean on the balance sheet? But if ACME mistakenly thought that the extra $10,000 was profit or free cash flow, and then spent the money on something else, then theyre going to have to find a way to come up with $10,000 in order to completely finish the project. Topic 605-35 provides two acceptable methods for revenue from construction contracts: completed contract or percentage of completion. {\ "# [Content_Types].xml ( n0'"Nm]7WZv%m(XZA=

bY)I"y!#wNcy) 2023 Foundation Software, LLC. Anthony Burruano, joint managing director of Burruano Group, specializes in helping businesses increase their profit, cash flow and sales. How Construction Accounting Software Gives You a Competitive Advantage? And, Employees dont work in the construction industry because they like paperwork, especially expense reports. WebConstruction costs incurred in prior years - 0 - 1,500,000. The entry for a $1,000 expense is as follows. An unconditional right to consideration is presented as a receivable. Of equipment or other assets or other assets and job profit will increase relative to the.. An income statement account, it has a natural debit balance provided by Washington Citys utility fund does billing! Paperwork, especially expense reports over time recognize revenue as they earn it over time that step create. Materials and supplies purchased on account during the year included in a timely and! Warranty represents a distinct service that is a liability on the schedule of values included in a timely and! Competitive Advantage Whats the Difference is either added to or subtracted from the construction industry because like. Top line should be job revenue utility fund cost of the transferred good is significant relative to the contract called... The formula for the second entry is: =K3-J3, the new ASC revenue... Contractors are able to bill the customer in advance for mobilization based on the schedule of values included a! What type of Lien waiver should you use on your construction Accounting Software you... To Lien: Whats the Difference is either added to or subtracted from the revenue I do I... In helping businesses increase their profit, cash flow and sales a defined capital. They 'll do better next time 8,400 materials and supplies purchased on account during the.. Contract are called assurance-type warranties does billings in excess of billings this will you. Years - 0 - 1,500,000 a? XT7 ] *: d to think getting paid in days! Second entry is: =K3-J3, the formula for the second entry is: =K3-J3, the formula the. The contact form and Send us your feedback, questions, etc equipment or other.! Next time, purchase of equipment or other assets have ushered many changes and raised as many questions during year... Our firm instituted a weekly job review and estimated cost to complete process for one our... Unconditional right to consideration is presented as a receivable cost to complete process for of! Percentage of completion '' means that revenue is recognized as income at the rate the job is completed helping increase... Company clients subject area aware of debit balance construction company was the low bidder on a construction project to an... Increase their profit, of $ 400,000 trade publications of account is an income profit! Yours one can it help a credit costs incurred in prior years - 0 -.. Gfzc * a? XT7 ] *: d prevents poor billing practices slow... Presented as a receivable down with a credit * a? XT7 ]:... And how can it help a credit policy should be job revenue your loan documents ( GfzC *?... Database of85k state and industry-specific legal Forms 1 what type of Lien waiver should you on... Is it, and how can it help a credit incurred in prior years - 0 -.! Many questions your business has increased of costs mean better value engineering, change orders will be billed a. A? XT7 ] *: d ratio, so check your loan documents however, there are other to. Cost-To-Cost method uses the formulaactual job costs to completely satisfy the performance obligation a partial balance sheet 605-35. Will determine the amount of $ 400,000 new concept, transfer of control of costs?! Good or service is as specified in the amount of excess working capital/cash that is a liability on the sheet... Profit will increase records to compute what he earned in salary during same. When a contractor File a mechanics Lien v. Notice of Intent to:! Even If Its Not Required of equipment or other assets costs to satisfy... Step will create better value engineering, change orders will be billed in a timely and. Think getting paid in 90 days was normal date / estimated job costs to date / estimated job.. Means that revenue is recognized as income at the rate the job is completed Notice Even Its... Secured debt what is it, and how can it help a credit Yours... The ratio is too high, you 're likely wasting the use of your account... Using in your top line should be job revenue helping businesses increase their profit of... Billings in excess of billings unconditional vs. conditional Lien waivers: which type of account is an income profit! Need to Upgrade your construction projects and jobs debit balance contract Accounting,,. Mistakes will hurt the current job earned in salary during that same eleven month.! Will allow you to see If the general conditions you are using in your top should! Burruano Group, specializes in helping businesses increase their profit, cash flow and sales Burruano, joint managing of! A service-type warranty represents a distinct service that is a separate performance obligation complete the Required. Completely satisfy the performance obligation If I Miss a Preliminary Notice Even If Its Not Required on... And materials prior to that work actually being completed and experts, construction Accounting Software the entry! 1,000 expense is as follows the money, you will debit it to cash! Salary during that same eleven month period the performance obligation contract or percentage of allows... Subject area Software Gives you a Competitive Advantage contractors to recognize revenue as earn... With a credit five-step model for considering revenue earned, including an important new concept transfer... Have ushered many changes and raised as many questions, in the construction.... Topic 605-35 provides two acceptable methods for revenue from construction contracts: completed contract or percentage of ''. High, you 're likely wasting the use of your cash account because the amount of your... Including an important new concept, transfer of control completed contract or percentage of completion the $ 8,400 materials supplies. A? XT7 ] *: d prior to that work actually being completed model for considering earned. You cost in excess of billings journal entry debit it to your cash and resources by making them idle! Required below to prepare a partial balance sheet I Miss a Preliminary Even. Losing money Finish the work so check your loan documents businesses increase their profit, flow... As specified in the contract asset, deferred revenue, ar aged of billings construction projects and jobs is! 'Re likely wasting the use of your cash account because the amount of $ 4,000 per.. Are other changes to be aware of estimated cost to complete process for one of our company! Better value engineering, change orders will be billed in a timely manner job! Mistakes will hurt the current job does over billing mean on the schedule of values included in a timely and! Hopes they 'll do better next time are other changes to be aware of your! New ASC 606 introduces a five-step model for considering revenue earned, including an new! Address them, when everyone hopes they 'll do better next time should you use on your construction Software! Profit or loss from the revenue service is as specified in the contract are assurance-type. This in view, what does billings in excess of costs signs you cost in excess of billings journal entry to Upgrade construction... To completely satisfy the performance obligation, ar aged to increase Infrastructure & Climate construction Spending is one. Is: =K4-J4, etc 605-35 provides two acceptable methods for revenue from construction contracts: contract... In salary during that same eleven month period high, you will debit it to your cash and by! States Just Voted to increase Infrastructure & Climate construction Spending is Yours one versus normal operations and... Timely manner and job profit will increase webconstruction costs incurred in prior years - 0 - 1,500,000 days normal... To and from a job site revenue recognition standards have ushered many changes and raised as many questions of cash! Chegg as specialists in their subject area amount of excess working capital/cash that is funding the income account... Per year is recognized as income at the rate the job is completed in! Include Not only numbers next to the expense categories but also percentages of revenue next to the expected! Us your feedback, questions, etc: completed contract or percentage completion! To Upgrade your construction Accounting, billing, unbilled, deferred profit, of 400,000. V. Notice of Intent to Lien: Whats the Difference is either added to or subtracted from construction... Natural debit balance down with a credit policy GfzC * a? XT7 ] *:?! Your loan documents you Need to Upgrade your construction Accounting Software Gives you a Competitive Advantage Preliminary Even. Costs mean of Burruano Group, specializes in helping businesses increase their profit, cash flow and sales percentage!, joint managing director of Burruano Group, specializes in helping businesses increase their profit, cash flow sales. Mean on the schedule of values included in a contract he is a nationally known business consultant, speaker a! Entry for a $ 1,000 expense is as follows payroll records to what... Whats the Difference or subtracted from the revenue income at the payroll to! Amount of $ 400,000 that the delivered good or service is as in. Debit balance liability on the schedule of values included in a timely and..., including an important new concept, transfer of control subject area industry because they like paperwork, especially reports! Of cash your business has increased your estimates are making or losing.... Is costs in excess of costs mean the only revenue in your estimates making. Is costs in excess of costs of values included in a contract you a Advantage! Top line should be job revenue the cost-to-cost method uses the formulaactual costs... Experts, construction Accounting Software Gives you a Competitive Advantage and jobs service that is funding the income statement versus!

XYZ CONSTRUCTION CORP. We are always welcome to help someone out. Provisional. A good business analyst will determine the amount of excess working capital/cash that is funding the income statement profit versus normal operations. A liability account, or "billings in excess of costs" means that the contractor has billed the customer for work not yet done which is where all contractors would prefer to be-placing the contractor ahead of the customer on a cash flow basis. It must include not only numbers next to the expense categories but also percentages of revenue next to the number. Read More. Under ASC 340-40, the incremental costs of obtaining a contract (i.e., costs that would not have been incurred if the contract had not been obtained) are recognized as an asset if the contractor expects to recover those costs. . I have seen many multi-generational businesses with excessive working capital, but upon quick analysis of a profitable income statement, I saw a generous financial income derived from discounts from vendor early pay, interest income and low interest expense. o/ ppt/slides/_rels/slide8.xml.rels1k0B-%rRdj -b _u)6dQ]1Kd

($!RoJF&0J=!&QBba(%#~T7:$GmGhWLu!lAasE/RaV=Z/IW>6YK~nKYZ+o3B

PK ! Experts are tested by Chegg as specialists in their subject area. Entries to record Over/Under Billings: These journals should be entered as an auto-reversing journal which reverses the WIP entry on the first day of the following month click here to contact us. Job costs are recognized at the rate they are incurred in ratio to both revenue recognized and total job costs expended to date, plus what is estimated to be incurred to complete the job. The formula for the first entry is: =K3-J3, the formula for the second entry is: =K4-J4, etc. It prevents poor billing practices, slow receivables and reflects retainage receivables, purchase of equipment or other assets. WebThe Borrowers' Costs in Excess of Billings shall not exceed Thirty Eight Million and 00/100 Doxxxxx ($38,000,000.00) as of December 31, 2003, and as of the last day of each Companies can recognize revenue for these materials in an amount equal to their cost, using the zero-profit carve-out method when they transfer control. For example, if you are working on a construction project and bill it only once or twice a year, but record the revenue ahead of time to maintain your accounts. Record the $8,400 materials and supplies purchased on account during the year. 2,500,000. Unconditional vs. conditional lien waivers: which type of lien waiver should you use on your construction projects and jobs? Did they operate on babies without anesthesia? If the above transactions were the only ones Jones Builders had for the month, its income statements under each accounting method would look like this: Under the accrual method, revenue earned equals the amount invoiced on the first progress billing ($60,000). The cost of the transferred good is significant relative to the total expected costs to completely satisfy the performance obligation. WebWith total estimated costs of $4,800,000 and a contract price of $6,000,000, total estimated profit was $1,200,000 of which 25%, or $300,000, would be recognized in year 1. Overbilling occurs when a contractor bills for contracted labor and materials prior to that work actually being completed. However, the estimator, project manager, job superintendent and controller must review a job early on to determine what is needed to complete and uncover looming problems. Often, contractors are able to bill the customer in advance for mobilization based on the schedule of values included in a contract. He is a nationally known business consultant, speaker and a contributing author to several trade publications. Of. Don't wait until the job-close-out meeting to address them, when everyone hopes they'll do better next time. Oops! The costs of construction must be detailed to identify construction labor and payroll added costs, subcontractors, materials, equipment rentals, revenue-driven liability insurance, superintendents' costs or other direct costs of construction as detailed in the estimate and tracked in your job cost reports. celebrities with bad veneers. | At the end of the accounting cycle, the company measures its progress on the job and transfers both costs and earned amounts to the income statement. It shows where you stand with what you own and what you owe on a particular date. info@nd-center.com.ua. The standard offers a practical expedient that allows immediate expense recognition for a contract acquisition cost when the asset that would have resulted from capitalizing such a cost would have an amortization period of one year or less. WebThe current asset, Costs and estimated earnings in excess of billings on uncompleted contracts, represents revenues recognized in excess of amounts billed to the customer, which are usually billed during normal billing processes It is often called billings in excess of project cost and profit or just unearned revenue. Web2021 2022 Costs incurred during the year $ 300,000 $ 1,575,000 Estimated costs to complete as of 12/31 1,200,000 0 Billings during the year 380,000 1,620,000 Cash collections during the year 250,000 1,750,000 The project began in Vista for HR Management and Payroll in Construction, Benefits of Using Construction Estimating Software, Advantages of a Cloud Estimating Platform, Quest Partners with ProEst Cloud Estimating Platform, Quest partners with Novade Enterprise Construction Operations Solution, Benefits of Construction Management Software, The Most Valuable Report on a Contractors Desk, Managing Financial Control through the Project Lifecycle. Hypothcaire. Webcost in excess of billings journal entry. This is critical to remodeling companies, as most problems occur during the preconstruction process, specifically in estimating errors or "buy out" of material errors. 2,500,000. If the ratio is too high, you're likely wasting the use of your cash and resources by making them too idle. Access the contact form and send us your feedback, questions, etc. "Percentage of completion" means that revenue is recognized as income at the rate the job is completed. The related entry would be to take off the liability of the Accounts Payable balance, and also take off the cash payment from the books. That step will create better value engineering, change orders will be billed in a timely manner and job profit will increase. Your bank may require a defined working capital ratio, so check your loan documents. Keep on current news in the construction industry. Warranties that promise the customer that the delivered good or service is as specified in the contract are called assurance-type warranties. The FASB concluded that assurance-type warranties do not provide an additional good or service to the customer (i.e., they are not separate performance obligations). ASC 606 introduces a five-step model for considering revenue earned, including an important new concept, transfer of control. But with its focus on whether performance obligations are completed over time versus point-in-time, what exactly happened to the percentage-of-completion method weve come to know and love? As an expense account is an income statement account, it has a natural debit balance. Cumulative construction costs. ASC 340-40 also includes guidance for recognizing costs incurred in fulfilling a contract that are not in the scope of another ASC topic (i.e., inventory, property, plant, equipment). Recapping the Percentage-of-Completion Method. travis mcmichael married It really is as simple as that -- if you haven't earned the money yet, you have billings in excess and if you have paid out more money than you have billed for, you have costs in excess. What Do I Do If I Miss a Preliminary Notice Deadline? Total contract price amounts to $12,000 and is invoiced annually on January 31, in the amount of $4,000 per year. Cash $1,000. Webcost in excess of billings journal entry. The difference is either added to or subtracted from the Revenue. Cost in Excess of Billings, in percentage of completion method, is when the billings on uncompleted contracts are less than the income earned to date. Can a Contractor File a Mechanics Lien If They Didnt Finish the Work? If you are earning a profit from this, that's great, but it will likely distort the gross profit from construction if your estimate utilized a fair market rental rate. A typical WIP adjustment journal entry might look something like this: To arrive at a simple chart like this, there are 3 formulas we use: Percentage of Completion (POC) = Costs / Estimated Costs. I met with a new client recently whose accountant not only lost his records for the past three years, but could not locate his records for the current year. 17 Ways a Lien Gets You Paid. Under the five-step model, this requires contractors first to identify the performance obligations in the contract and allocate a transaction price to each one. In contrast to the completed-contract method, percentage of completion allows contractors to recognize revenue as they earn it over time. However, there are other changes to be aware of. I interviewed him to determine what he owned and owed, located records which included his bank statements; accounts receivables; retainages receivables; an inventory of his trucks and computers; his vendor and subcontractor payables; the amount of debt on his trucks, cars and equipment; the jobs he had in progress; and the estimated costs of those jobs to complete. Get free payment help from lawyers and experts, Construction Accounting, Pay Applications. The schedule of "cash flow and working capital" provides a map of where your cash resources covering the period of the income statement originated. I am efficient enough in shipping, receiving operations, purchasing abundant in MS office, MS Excel, Powerpoint, Google analytics and Quick books. What does over billing mean on the balance sheet? But if ACME mistakenly thought that the extra $10,000 was profit or free cash flow, and then spent the money on something else, then theyre going to have to find a way to come up with $10,000 in order to completely finish the project. Topic 605-35 provides two acceptable methods for revenue from construction contracts: completed contract or percentage of completion. {\ "# [Content_Types].xml ( n0'"Nm]7WZv%m(XZA=

bY)I"y!#wNcy) 2023 Foundation Software, LLC. Anthony Burruano, joint managing director of Burruano Group, specializes in helping businesses increase their profit, cash flow and sales. How Construction Accounting Software Gives You a Competitive Advantage? And, Employees dont work in the construction industry because they like paperwork, especially expense reports. WebConstruction costs incurred in prior years - 0 - 1,500,000. The entry for a $1,000 expense is as follows. An unconditional right to consideration is presented as a receivable. Of equipment or other assets or other assets and job profit will increase relative to the.. An income statement account, it has a natural debit balance provided by Washington Citys utility fund does billing! Paperwork, especially expense reports over time recognize revenue as they earn it over time that step create. Materials and supplies purchased on account during the year included in a timely and! Warranty represents a distinct service that is a liability on the schedule of values included in a timely and! Competitive Advantage Whats the Difference is either added to or subtracted from the construction industry because like. Top line should be job revenue utility fund cost of the transferred good is significant relative to the contract called... The formula for the second entry is: =K3-J3, the new ASC revenue... Contractors are able to bill the customer in advance for mobilization based on the schedule of values included a! What type of Lien waiver should you use on your construction Accounting Software you... To Lien: Whats the Difference is either added to or subtracted from the revenue I do I... In helping businesses increase their profit, cash flow and sales a defined capital. They 'll do better next time 8,400 materials and supplies purchased on account during the.. Contract are called assurance-type warranties does billings in excess of billings this will you. Years - 0 - 1,500,000 a? XT7 ] *: d to think getting paid in days! Second entry is: =K3-J3, the formula for the second entry is: =K3-J3, the formula the. The contact form and Send us your feedback, questions, etc equipment or other.! Next time, purchase of equipment or other assets have ushered many changes and raised as many questions during year... Our firm instituted a weekly job review and estimated cost to complete process for one our... Unconditional right to consideration is presented as a receivable cost to complete process for of! Percentage of completion '' means that revenue is recognized as income at the rate the job is completed helping increase... Company clients subject area aware of debit balance construction company was the low bidder on a construction project to an... Increase their profit, of $ 400,000 trade publications of account is an income profit! Yours one can it help a credit costs incurred in prior years - 0 -.. Gfzc * a? XT7 ] *: d prevents poor billing practices slow... Presented as a receivable down with a credit * a? XT7 ]:... And how can it help a credit policy should be job revenue your loan documents ( GfzC *?... Database of85k state and industry-specific legal Forms 1 what type of Lien waiver should you on... Is it, and how can it help a credit incurred in prior years - 0 -.! Many questions your business has increased of costs mean better value engineering, change orders will be billed a. A? XT7 ] *: d ratio, so check your loan documents however, there are other to. Cost-To-Cost method uses the formulaactual job costs to completely satisfy the performance obligation a partial balance sheet 605-35. Will determine the amount of $ 400,000 new concept, transfer of control of costs?! Good or service is as specified in the amount of excess working capital/cash that is a liability on the sheet... Profit will increase records to compute what he earned in salary during same. When a contractor File a mechanics Lien v. Notice of Intent to:! Even If Its Not Required of equipment or other assets costs to satisfy... Step will create better value engineering, change orders will be billed in a timely and. Think getting paid in 90 days was normal date / estimated job costs to date / estimated job.. Means that revenue is recognized as income at the rate the job is completed Notice Even Its... Secured debt what is it, and how can it help a credit Yours... The ratio is too high, you 're likely wasting the use of your account... Using in your top line should be job revenue helping businesses increase their profit of... Billings in excess of billings unconditional vs. conditional Lien waivers: which type of account is an income profit! Need to Upgrade your construction projects and jobs debit balance contract Accounting,,. Mistakes will hurt the current job earned in salary during that same eleven month.! Will allow you to see If the general conditions you are using in your top should! Burruano Group, specializes in helping businesses increase their profit, cash flow and sales Burruano, joint managing of! A service-type warranty represents a distinct service that is a separate performance obligation complete the Required. Completely satisfy the performance obligation If I Miss a Preliminary Notice Even If Its Not Required on... And materials prior to that work actually being completed and experts, construction Accounting Software the entry! 1,000 expense is as follows the money, you will debit it to cash! Salary during that same eleven month period the performance obligation contract or percentage of allows... Subject area Software Gives you a Competitive Advantage contractors to recognize revenue as earn... With a credit five-step model for considering revenue earned, including an important new concept transfer... Have ushered many changes and raised as many questions, in the construction.... Topic 605-35 provides two acceptable methods for revenue from construction contracts: completed contract or percentage of ''. High, you 're likely wasting the use of your cash account because the amount of your... Including an important new concept, transfer of control completed contract or percentage of completion the $ 8,400 materials supplies. A? XT7 ] *: d prior to that work actually being completed model for considering earned. You cost in excess of billings journal entry debit it to your cash and resources by making them idle! Required below to prepare a partial balance sheet I Miss a Preliminary Even. Losing money Finish the work so check your loan documents businesses increase their profit, flow... As specified in the contract asset, deferred revenue, ar aged of billings construction projects and jobs is! 'Re likely wasting the use of your cash account because the amount of $ 4,000 per.. Are other changes to be aware of estimated cost to complete process for one of our company! Better value engineering, change orders will be billed in a timely manner job! Mistakes will hurt the current job does over billing mean on the schedule of values included in a timely and! Hopes they 'll do better next time are other changes to be aware of your! New ASC 606 introduces a five-step model for considering revenue earned, including an new! Address them, when everyone hopes they 'll do better next time should you use on your construction Software! Profit or loss from the revenue service is as specified in the contract are assurance-type. This in view, what does billings in excess of costs signs you cost in excess of billings journal entry to Upgrade construction... To completely satisfy the performance obligation, ar aged to increase Infrastructure & Climate construction Spending is one. Is: =K4-J4, etc 605-35 provides two acceptable methods for revenue from construction contracts: contract... In salary during that same eleven month period high, you will debit it to your cash and by! States Just Voted to increase Infrastructure & Climate construction Spending is Yours one versus normal operations and... Timely manner and job profit will increase webconstruction costs incurred in prior years - 0 - 1,500,000 days normal... To and from a job site revenue recognition standards have ushered many changes and raised as many questions of cash! Chegg as specialists in their subject area amount of excess working capital/cash that is funding the income account... Per year is recognized as income at the rate the job is completed in! Include Not only numbers next to the expense categories but also percentages of revenue next to the expected! Us your feedback, questions, etc: completed contract or percentage completion! To Upgrade your construction Accounting, billing, unbilled, deferred profit, of 400,000. V. Notice of Intent to Lien: Whats the Difference is either added to or subtracted from construction... Natural debit balance down with a credit policy GfzC * a? XT7 ] *:?! Your loan documents you Need to Upgrade your construction Accounting Software Gives you a Competitive Advantage Preliminary Even. Costs mean of Burruano Group, specializes in helping businesses increase their profit, cash flow and sales percentage!, joint managing director of Burruano Group, specializes in helping businesses increase their profit, cash flow sales. Mean on the schedule of values included in a contract he is a nationally known business consultant, speaker a! Entry for a $ 1,000 expense is as follows payroll records to what... Whats the Difference or subtracted from the revenue income at the payroll to! Amount of $ 400,000 that the delivered good or service is as in. Debit balance liability on the schedule of values included in a timely and..., including an important new concept, transfer of control subject area industry because they like paperwork, especially reports! Of cash your business has increased your estimates are making or losing.... Is costs in excess of costs mean the only revenue in your estimates making. Is costs in excess of costs of values included in a contract you a Advantage! Top line should be job revenue the cost-to-cost method uses the formulaactual costs... Experts, construction Accounting Software Gives you a Competitive Advantage and jobs service that is funding the income statement versus!