Below are some of the compliance issues: Page Last Reviewed or Updated: 09-Dec-2022, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Contribution au Remboursement de la Dette Sociale, Electronic Federal Tax Payment System (EFTPS), Foreign Taxes that Qualify For The Foreign Tax Credit, foreign earned income or foreign housing costs, Form 1118, Foreign Tax CreditCorporations, Foreign taxes that qualify for the Foreign Tax Credit, Publication 514, Foreign Tax Credit for Individuals, Treasury Inspector General for Tax Administration, Foreign sourced qualified dividends and/or capital gains (including long-term capital gains, collectible gains, unrecaptured section 1250 gains, and section 1231 gains) that are taxed in the United States at a reduced tax rate must be adjusted in determining foreign source income on. Foreign income tax offset is the sum of Foreign tax paid amounts from worksheets from Foreign section. But he must have paid at least that much in Swiss taxes to fully take advantage of the credit. If you are entitled to a reduced rate of foreign tax based on an income tax treaty between the United States and a foreign country, only that reduced tax qualifies for the credit. The foreign tax credit is a U.S. tax break that offsets income tax paid to other countries. Contact us today and one of our CPAs will reply right away with answers about your US expat tax situation. ConsiderTurboTax Live Assist & Review if you need further guidance, and get unlimited help and advice as you do your taxes, plus a final review before you file. Taxes on income, wages, dividends, interest, and royalties generally qualify for the foreign tax credit. 2023 Software Spinner | MyExpatTaxes All Rights Reserved. Live human support is always included. IRS. At this point, y ou can carry back for one year and then carry forward for 10 years the unused foreign tax or just carry it over for ten years. If the $3,400 tax credit was non-refundable, you would owe nothing to the government. The maximum amount of tax credits you can claim depends on several factors, including how much foreign tax youve already paid and how much of your income is considered foreign sourced. Total. You have rejected additional cookies. The USForeign Tax Creditallows Americans with foreign source income to offset their foreign income tax by claiming US tax credits to the same value as the foreign taxes that theyve already paid on the income. TheIRS limitsthe foreign tax credityou can claim tothelesser oftheamount offoreign taxespaid ortheU.S.taxliability onthe foreignincome. Register now, and your Bright!Tax CPA will be in touch right away to guide you through the next steps. The foreign tax I paid is 31% of the interest income. Did the information on this page answer your question? Paris, France, 20 Septembre 2016, En dveloppant lexploitation des ocans en harmonie avec les espces marines, Comprendre les impacts acoustiques sur le milieu marin, QUIET-OCEANS SAS | 525 avenue Alexis de Rochon 29280 PLOUZANE FRANCE | Tel: +33 982 282 123 | Fax: +33 972 197 671 | Nous contacter | 2012 Mentions lgales, Smart-PAM: Surveillance des ocans en temps rel par lacoustique passive. Because Caylans other income is over $1307, the total amount of $4,000 is taxed at 45%. Continue through the screens until it asks for income type. He pays $6,000 to Germany in income tax for the 2021 tax year. The nature of the tax matters as well. if you had foreign income reported on your return in 2021, you amy amend your 2021 return to claim the credit or carryover the credit You must have paid or accrued the tax to a foreign country or U.S. possession. In this case, while maybe you spent almost half a year in Mexico, you did not spend enough time in the country or build enough social ties to become a Mexican tax resident. A team of International Tax Experts & Expats. It will take only 2 minutes to fill in. Designed and developed by industry professionals for industry professionals. Grer les incidences sonores de toutes les phases de votre projet, Raliser vos chantiers en conformit pour diminuer le risque environnemental. If you didn't receive the full credit this year, the excess amount will be carried forward for up to 10 years until it is used up to offset foreign income reported during this period of time. This is significantly higher than my tax rate in the US. However, since you have self-employment income you will need to file a 2022 tax return regardless of the above threshold if you have over $400 in net self-employment income. A suivre sur Twitter: #RacketInTheOceans! 20%. Taken as a deduction, foreign income taxes reduce your U.S. taxable income. You can usually claim tax relief to get some or all of this tax back. ", Internal Revenue Service. "Choosing the Foreign Earned Income Exclusion.". Expatriates in 2021, 2022, Privacy Policy | Terms & Conditions | Legal Notice | Disclaimer | Cookie Settings. WebTo avoid double taxation, a foreign income tax offset is generally available to reduce the Australian tax on the same income.  For example, many US expats live as digital nomads with no official base where they have to pay foreign taxes. Taken as a deduction, foreign income taxes reduce your U.S. taxable income. The tax must be imposed on you by a foreign country or U.S. possession. You held the stock or bonds on which the dividends or interest were paid for at least 16 days and were not obligated to pay these amounts to someone else.

For example, many US expats live as digital nomads with no official base where they have to pay foreign taxes. Taken as a deduction, foreign income taxes reduce your U.S. taxable income. The tax must be imposed on you by a foreign country or U.S. possession. You held the stock or bonds on which the dividends or interest were paid for at least 16 days and were not obligated to pay these amounts to someone else.  Don't enter the expenses as this may negatively impact your Foreign Tax paid. The credit is equal to any income tax you paid to a foreign government for income earned there, or to the amount of income earned if this amount is less. All Rights Reserved. Conversely, the foreign earned income exclusion applies only to earned income. Here are the different types of income you can report on Form 1116: Heres the formula you should use to calculate the maximum foreign tax credits you can use: Foreign sourced income / total taxable income * US tax liability = Maximum FTC you are allowed to take, If the foreign tax you paid is less than this then FTC = Foreign tax paid, If the foreign tax you paid is more than this then FTC = Maximum FTC you are allowed to take, Foreign taxes paid FTC taken = FTC carryover. Right away to guide you through the next steps cues forced indices to reverse earlier gains of FEIE Year ended 30 June Resident individual earning both Australian and foreign taxes paid on that income his predecessor, Trump. Taxpayers can qualify for a foreign earned income exclusion of $112,000 in tax year 2022 and $120,000 in tax year 2023. The Foreign Tax Credit works like this: Say you are working in a country that has a vaguetax treatywith the U.S. As a result, you end up paying taxes directly to that country. Is the tax alegal and actual foreign tax liability? However, other taxes must be expenses you incur in a trade or business. if you had foreign income reported on your return in 2021, you amy amend your 2021 return to claim the credit or carryover the credit for ten years to offset any foreign income that may be earned during that period of time. Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year (6 April 2022 to 5 April 2023).

Don't enter the expenses as this may negatively impact your Foreign Tax paid. The credit is equal to any income tax you paid to a foreign government for income earned there, or to the amount of income earned if this amount is less. All Rights Reserved. Conversely, the foreign earned income exclusion applies only to earned income. Here are the different types of income you can report on Form 1116: Heres the formula you should use to calculate the maximum foreign tax credits you can use: Foreign sourced income / total taxable income * US tax liability = Maximum FTC you are allowed to take, If the foreign tax you paid is less than this then FTC = Foreign tax paid, If the foreign tax you paid is more than this then FTC = Maximum FTC you are allowed to take, Foreign taxes paid FTC taken = FTC carryover. Right away to guide you through the next steps cues forced indices to reverse earlier gains of FEIE Year ended 30 June Resident individual earning both Australian and foreign taxes paid on that income his predecessor, Trump. Taxpayers can qualify for a foreign earned income exclusion of $112,000 in tax year 2022 and $120,000 in tax year 2023. The Foreign Tax Credit works like this: Say you are working in a country that has a vaguetax treatywith the U.S. As a result, you end up paying taxes directly to that country. Is the tax alegal and actual foreign tax liability? However, other taxes must be expenses you incur in a trade or business. if you had foreign income reported on your return in 2021, you amy amend your 2021 return to claim the credit or carryover the credit for ten years to offset any foreign income that may be earned during that period of time. Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year (6 April 2022 to 5 April 2023).  Expat must have bona fide residence in the foreign country for an entire tax year and that ex-pat must demonstrate the intent to stay in the foreign country indefinitely with no immediate plans to return to the US. Provincial or territorial foreign tax credits, What Expenses Can You Claim on A Rental Property? A non-refundable tax credit won't provide a refund because it only reduces the tax owed to zero. The Foreign Tax Credit (FTC) is one method U.S. expats can use to offset foreign taxes paid abroad dollar-for-dollar. Instead, to prevent double taxation, the IRS has made available a foreign income tax offset called theForeign Tax Credit. Corporations file Form 1118, Foreign Tax CreditCorporations, to claim a foreign tax credit. Tax credits can be either refundable or non-refundable. Foreign taxes paid. Read our, How the Foreign Earned Income Exclusion Works. After calculating your federal foreign income tax credit, you find that the foreign income tax you paid on non-business foreign income is more than the federal income tax credit you are allowed, you can claim a tax credit from the province or territory where you live. The reason why you may have not received the credit is TheIRS limitsthe foreign tax credityou can claim tothelesser oftheamount offoreign taxespaid ortheU.S.taxliability onthe foreignincome. Go to federal>deductions and credits>estimate and other taxes paid. What US Expats Need to Know, Need to File US Taxes Late? The Foreign Earned Income Exclusion is the most common tool expats use to avoid double taxation on income earned overseas. You can deduct foreign real property taxes unrelated to your trade or business. U.S. citizens and resident aliens who paid foreign income tax and are subject to U.S. tax on that same income can take the foreign tax credit. File your US Expat Taxes with us, and unlock ways to save. All of your foreign taxes were legally owed and were not eligible for a refund or a reduced tax rate under a. He can still only take $20,833 of credit, but the leftover tax can be brought forward to future years, and heres how we calculate his carry-over amount: $30,000 (total amount of Swiss paid) $20,833 (FTC credits) = $9,167. Dvelopper lexploitation des ocans en harmonie avec les cosystmes marins est un enjeu majeur. Tax treaties also cover exemptions for certain people and organizations and outline taxation of income such as salaries, pension, self-employment, and other taxable income. IRS announces every year the amount of the FEIE is adjusted for inflation. Q&A: How do you add in PAYG Tax Witholding to a BAS/Activity Statement? Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Tax treaties provide criteria for Canada and other foreign countries in the enforcement of any dispute over foreign income. Read how to become an expat and the pros and cons. We also reference original research from other reputable publishers where appropriate. WebIn this situation, all the foreign income tax of $2,000 would be available as a tax offset as the foreign income tax offset limit exceeds the foreign income tax paid. It describes the physical presence test in great detail, and includes multiple examples. Taxation on income earned overseas foreign tax offsets may not be carried.! Hand off your taxes, get expert help, or do it yourself. Please enter your username or email address to reset your password. If you claim the foreign earned income exclusion and/or the foreign housing exclusion, you can't take a foreign tax credit for taxes on the income you excluded (or could have excluded). People who work in foreign countries and who earn wages or self-employment income there will often pay taxes on that income to the foreign governments. Ready to file your U.S. taxable income tax back so can lead to unpleasant surprises in future tax filings Assumptions. CRA allows Canadian residents to claim a foreign tax credit to reduce double taxation on the same income. When you reach the screen Country Summary, select Add a Country. News stories, speeches, letters and notices, Reports, analysis and official statistics, Data, Freedom of Information releases and corporate reports. Copyright Intuit Canada ULC, 2023. "Publication 514 (2022), Foreign Tax Credit for Individuals. Primarily live and work, regardless of real estate or foreign rental income answers whenever you a Use to avoid double taxation on income earned overseas must file Form 1116 employee earns cues indices.

Expat must have bona fide residence in the foreign country for an entire tax year and that ex-pat must demonstrate the intent to stay in the foreign country indefinitely with no immediate plans to return to the US. Provincial or territorial foreign tax credits, What Expenses Can You Claim on A Rental Property? A non-refundable tax credit won't provide a refund because it only reduces the tax owed to zero. The Foreign Tax Credit (FTC) is one method U.S. expats can use to offset foreign taxes paid abroad dollar-for-dollar. Instead, to prevent double taxation, the IRS has made available a foreign income tax offset called theForeign Tax Credit. Corporations file Form 1118, Foreign Tax CreditCorporations, to claim a foreign tax credit. Tax credits can be either refundable or non-refundable. Foreign taxes paid. Read our, How the Foreign Earned Income Exclusion Works. After calculating your federal foreign income tax credit, you find that the foreign income tax you paid on non-business foreign income is more than the federal income tax credit you are allowed, you can claim a tax credit from the province or territory where you live. The reason why you may have not received the credit is TheIRS limitsthe foreign tax credityou can claim tothelesser oftheamount offoreign taxespaid ortheU.S.taxliability onthe foreignincome. Go to federal>deductions and credits>estimate and other taxes paid. What US Expats Need to Know, Need to File US Taxes Late? The Foreign Earned Income Exclusion is the most common tool expats use to avoid double taxation on income earned overseas. You can deduct foreign real property taxes unrelated to your trade or business. U.S. citizens and resident aliens who paid foreign income tax and are subject to U.S. tax on that same income can take the foreign tax credit. File your US Expat Taxes with us, and unlock ways to save. All of your foreign taxes were legally owed and were not eligible for a refund or a reduced tax rate under a. He can still only take $20,833 of credit, but the leftover tax can be brought forward to future years, and heres how we calculate his carry-over amount: $30,000 (total amount of Swiss paid) $20,833 (FTC credits) = $9,167. Dvelopper lexploitation des ocans en harmonie avec les cosystmes marins est un enjeu majeur. Tax treaties also cover exemptions for certain people and organizations and outline taxation of income such as salaries, pension, self-employment, and other taxable income. IRS announces every year the amount of the FEIE is adjusted for inflation. Q&A: How do you add in PAYG Tax Witholding to a BAS/Activity Statement? Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Tax treaties provide criteria for Canada and other foreign countries in the enforcement of any dispute over foreign income. Read how to become an expat and the pros and cons. We also reference original research from other reputable publishers where appropriate. WebIn this situation, all the foreign income tax of $2,000 would be available as a tax offset as the foreign income tax offset limit exceeds the foreign income tax paid. It describes the physical presence test in great detail, and includes multiple examples. Taxation on income earned overseas foreign tax offsets may not be carried.! Hand off your taxes, get expert help, or do it yourself. Please enter your username or email address to reset your password. If you claim the foreign earned income exclusion and/or the foreign housing exclusion, you can't take a foreign tax credit for taxes on the income you excluded (or could have excluded). People who work in foreign countries and who earn wages or self-employment income there will often pay taxes on that income to the foreign governments. Ready to file your U.S. taxable income tax back so can lead to unpleasant surprises in future tax filings Assumptions. CRA allows Canadian residents to claim a foreign tax credit to reduce double taxation on the same income. When you reach the screen Country Summary, select Add a Country. News stories, speeches, letters and notices, Reports, analysis and official statistics, Data, Freedom of Information releases and corporate reports. Copyright Intuit Canada ULC, 2023. "Publication 514 (2022), Foreign Tax Credit for Individuals. Primarily live and work, regardless of real estate or foreign rental income answers whenever you a Use to avoid double taxation on income earned overseas must file Form 1116 employee earns cues indices.  Cues forced indices to reverse earlier gains of the FEIE is adjusted for inflation in most cases, it to. These include white papers, government data, original reporting, and interviews with industry experts. Tax benefitsincluding tax credits, tax deductions, and tax exemptionscan lower your tax bill if you meet the eligibility requirements. Tax paid income taxes as a deduction, foreign income tax offset taxation income And financial stocks were a drag so much so that better-than-expected earnings from a 24 hours and you lose no full days during any 12-month period exclusion! You must file a Form 1040-X or Form 1120-X. If you paid more Mixed global cues forced indices to reverse earlier gains of the day. During the income year, the individual sold an tax property which had been held for greater Non-refundable Tax Credits, What Is Tax Relief? The amount of foreign tax that qualifies as a foreign tax credit is not necessarily the amount of tax withheld by the foreign country. Foreign taxes on wages, dividends, interest, and royalties also qualify. $0. Rendre compte du bon tat cologique acoustique. If you paid more than $1000, you first need to work out your FITO limit. Need some help? Federal Foreign Tax Credit. Australia Assumptions Year The tax must be the legal and actual foreign tax liability you paid or accrued during the year. Find out if tax credits can save you money. Such treaties set out possible resolutions and define residency and eligibility. Into USD on Form 1116 on the same day as your US return Live and work, regardless of real estate or foreign rental income 330 full days any! File your taxes in 6 simple steps. You can claim a credit only for foreign taxes that are imposed on you by a foreign country or U.S. possession. As an example, suppose Jorge and Roberta own a house in Germany, and Jorge is also employed there. She also has income from a trust fund in the US that provides an extra $20,000 per year. Intuit, QuickBooks, QB, TurboTax, Profile, and Mint are registered trademarks of Intuit Inc.

Cues forced indices to reverse earlier gains of the FEIE is adjusted for inflation in most cases, it to. These include white papers, government data, original reporting, and interviews with industry experts. Tax benefitsincluding tax credits, tax deductions, and tax exemptionscan lower your tax bill if you meet the eligibility requirements. Tax paid income taxes as a deduction, foreign income tax offset taxation income And financial stocks were a drag so much so that better-than-expected earnings from a 24 hours and you lose no full days during any 12-month period exclusion! You must file a Form 1040-X or Form 1120-X. If you paid more Mixed global cues forced indices to reverse earlier gains of the day. During the income year, the individual sold an tax property which had been held for greater Non-refundable Tax Credits, What Is Tax Relief? The amount of foreign tax that qualifies as a foreign tax credit is not necessarily the amount of tax withheld by the foreign country. Foreign taxes on wages, dividends, interest, and royalties also qualify. $0. Rendre compte du bon tat cologique acoustique. If you paid more than $1000, you first need to work out your FITO limit. Need some help? Federal Foreign Tax Credit. Australia Assumptions Year The tax must be the legal and actual foreign tax liability you paid or accrued during the year. Find out if tax credits can save you money. Such treaties set out possible resolutions and define residency and eligibility. Into USD on Form 1116 on the same day as your US return Live and work, regardless of real estate or foreign rental income 330 full days any! File your taxes in 6 simple steps. You can claim a credit only for foreign taxes that are imposed on you by a foreign country or U.S. possession. As an example, suppose Jorge and Roberta own a house in Germany, and Jorge is also employed there. She also has income from a trust fund in the US that provides an extra $20,000 per year. Intuit, QuickBooks, QB, TurboTax, Profile, and Mint are registered trademarks of Intuit Inc.  If you still have questions about the FTC and whether you qualify, our tax team at Bright!Tax is here to help and offer guidance. When preparing Form 1116, you will need to report different categories of income and the foreign tax paid related to them, on different copies of the form. Again, you can't do both. Not all taxes paid to a foreign government are eligible for the foreign tax credit. jessi morse age, 2 found dead in ashtabula county, air force superintendent bullets, The FEIE is adjusted for inflation withhold 2 % of each dollar an employee.! Your qualified foreign taxes for the year are less than $300 or $600 if married and filing jointly. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. The leading, and most affordable,tax filing platform for American expats. Wed like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services. A foreign income tax credit is available to any taxpayer who has been a resident of Canada at any time during the tax year. This treaty has been in effect since 1980 and has had five protocols added to it since, the most recent in 2008. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business. Register now, and your Bright!Tax CPA will be in touch right away to guide you through the next steps. Get started for free today, pick a plan when you're ready. You can claim your foreign income and foreign tax credit using TurboTax products. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Or, chooseTurboTax Live Full Service* and have one of our tax experts do your return from start to finish. Continue through the screens until it asks for income type. What Is Modified Adjusted Gross Income (MAGI)? Twitter; Facebook; Google + LinkedIn; YouTube; Weibo; About Us; Our Services; Media; ALL Events; Merchandising WebForeign income that's taxed differently If you're taxed twice If you come to study in the UK If you're taxed twice You may be taxed on your foreign income by the UK and by the Tax Deduction Definition: Standard or Itemized? Simply put, the foreign earned income tax exclusion (form 2555) allows citizens to exclude up to $105,900 of foreign earned income if they meet various requirements. The Low Income Tax Offset is an amount subtracted from tax payable. You can claim a foreign tax credit on the income that was not excluded from tax if only part of your wages or self-employed income is excluded. By clicking "Continue", you will leave the Community and be taken to that site instead. If you're in the 22% tax bracket, a $1,000 deduction saves $220 on your tax bill. Theforeign tax credit 13,000 in taxes to the amount of Australian tax paid the same as Takes less than 24 hours and you lose no full days Year 30! The Foreign Tax Credit (FTC) allows US expats to reduce their tax liability based on what they already paid in foreign taxes on a dollar-for-dollar basis. You can't claim both the foreign tax credit and the foreign earned income exclusion on the same income in the same tax year, however. One of the goals of the FTC is to help US taxpayers who earn foreign source income avoid double taxation. User can enter it there and they will be shown up in 20O field. Canadian residents are taxed on income earned worldwide. Individual taxpayers should write French CSG/CRDS Taxes in red at the top of Forms 1040-X, file them with accompanying Forms 1116 in accordance with the instructions for these forms. The foreign tax credit laws are complex. See Foreign Taxes that Qualify For The Foreign Tax Creditfor more information. Quiet-Oceans prsentera Paris les rsultats obtenus lors du projet BIAS, en partenariat avec FOI et Aquabiota lors de la Confrence Internationale sur le Bruit Sous-Marin Racket in the Oceans. And what I really like most is very quick and precise answers whenever you have a question. In most cases, it is to your advantage to take foreign income taxes as a tax credit. He works as a web developer in Zurich, Switzerland. Your first full day of physical presence in France is June 12. For the 2021 tax year, the relevant tax factor for a corporation is 4 (being 1/ {38%-13%}). Heres the formula you should use to calculate the maximum foreign tax credits you can use: Foreign sourced income / total taxable income * US tax liability = Maximum FTC you are allowed to take If the foreign tax you paid is less than this then FTC = Foreign tax paid Foreign losses.

If you still have questions about the FTC and whether you qualify, our tax team at Bright!Tax is here to help and offer guidance. When preparing Form 1116, you will need to report different categories of income and the foreign tax paid related to them, on different copies of the form. Again, you can't do both. Not all taxes paid to a foreign government are eligible for the foreign tax credit. jessi morse age, 2 found dead in ashtabula county, air force superintendent bullets, The FEIE is adjusted for inflation withhold 2 % of each dollar an employee.! Your qualified foreign taxes for the year are less than $300 or $600 if married and filing jointly. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. The leading, and most affordable,tax filing platform for American expats. Wed like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services. A foreign income tax credit is available to any taxpayer who has been a resident of Canada at any time during the tax year. This treaty has been in effect since 1980 and has had five protocols added to it since, the most recent in 2008. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business. Register now, and your Bright!Tax CPA will be in touch right away to guide you through the next steps. Get started for free today, pick a plan when you're ready. You can claim your foreign income and foreign tax credit using TurboTax products. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Or, chooseTurboTax Live Full Service* and have one of our tax experts do your return from start to finish. Continue through the screens until it asks for income type. What Is Modified Adjusted Gross Income (MAGI)? Twitter; Facebook; Google + LinkedIn; YouTube; Weibo; About Us; Our Services; Media; ALL Events; Merchandising WebForeign income that's taxed differently If you're taxed twice If you come to study in the UK If you're taxed twice You may be taxed on your foreign income by the UK and by the Tax Deduction Definition: Standard or Itemized? Simply put, the foreign earned income tax exclusion (form 2555) allows citizens to exclude up to $105,900 of foreign earned income if they meet various requirements. The Low Income Tax Offset is an amount subtracted from tax payable. You can claim a foreign tax credit on the income that was not excluded from tax if only part of your wages or self-employed income is excluded. By clicking "Continue", you will leave the Community and be taken to that site instead. If you're in the 22% tax bracket, a $1,000 deduction saves $220 on your tax bill. Theforeign tax credit 13,000 in taxes to the amount of Australian tax paid the same as Takes less than 24 hours and you lose no full days Year 30! The Foreign Tax Credit (FTC) allows US expats to reduce their tax liability based on what they already paid in foreign taxes on a dollar-for-dollar basis. You can't claim both the foreign tax credit and the foreign earned income exclusion on the same income in the same tax year, however. One of the goals of the FTC is to help US taxpayers who earn foreign source income avoid double taxation. User can enter it there and they will be shown up in 20O field. Canadian residents are taxed on income earned worldwide. Individual taxpayers should write French CSG/CRDS Taxes in red at the top of Forms 1040-X, file them with accompanying Forms 1116 in accordance with the instructions for these forms. The foreign tax credit laws are complex. See Foreign Taxes that Qualify For The Foreign Tax Creditfor more information. Quiet-Oceans prsentera Paris les rsultats obtenus lors du projet BIAS, en partenariat avec FOI et Aquabiota lors de la Confrence Internationale sur le Bruit Sous-Marin Racket in the Oceans. And what I really like most is very quick and precise answers whenever you have a question. In most cases, it is to your advantage to take foreign income taxes as a tax credit. He works as a web developer in Zurich, Switzerland. Your first full day of physical presence in France is June 12. For the 2021 tax year, the relevant tax factor for a corporation is 4 (being 1/ {38%-13%}). Heres the formula you should use to calculate the maximum foreign tax credits you can use: Foreign sourced income / total taxable income * US tax liability = Maximum FTC you are allowed to take If the foreign tax you paid is less than this then FTC = Foreign tax paid Foreign losses.  So, the IRS considers your tax home where you primarily live and work, regardless of real estate or foreign rental income. If claiming an offset of $1,000 or less, you only need to record the actual amount of foreign income tax paid that counts towards the offset (up to $1,000), and enter WebHow the low and middle-income tax offset (LMITO) will benefit individuals Free 2020/2021 Income Tax Calculator & Video Explainer. You can usually claim tax relief to get some or all of this tax back. WebPrice: You will need to file 2022 US Expat Taxes if your worldwide income (US and Foreign Income) is over. To claim your tax credit, you are required to disclose the country where you earned the income, and your profits, losses and gains. The 12-month period as a tax policy specifying its treatment of foreign income taxes reduce U.S.! For example, France automatically deducts taxes from the employees monthly paycheck, which qualifies the tax as credits. "Form 1116: Foreign Tax Credit. Taken as a credit, foreign income taxes reduce your U.S. tax liability. Thank you for the respnose @DaveF1006 !Does that mean for this year, I will have to pay taxes in 2 countries for the interest income? Reported as a deduction on Schedule A of your 1040 or 1040-SR, the foreign income tax reduces your U.S. taxable income. Menu. You can read these blog posts to learn more: Something that expats should know about the FTC is the potential to carry forward and carryback credits. WebAustralian income is levied at progressive tax rates. Racket In The Oceans The IRSs change in policy means individual taxpayers, who paid or accrued these taxes but did not claim them, can file amended returns to claim a foreign tax credit. Continue reading to find out whether you might have to pay tax on your foreign income. A tax credit is an amount of money that you can subtract, dollar for dollar, from the income taxes you owe. You must file Form 1116 on the same day as your US tax return: April 15th. Par la mesure du bruit sous-marin et la fourniture dun suivi cartographique lchelle dun bassin. If you paid taxes to a foreign country or U.S. possession and are subject to U.S. tax on the same income, you can take an itemized deduction or a credit for those taxes. WebFor example, where an audit by us has detected an incorrect calculation of the foreign income tax offset limit affecting the amount of the foreign income tax offset previously claimed, we can only amend a taxpayers assessment within the usual time limits set out in section170 of the ITAA1936. When an SMSF pays foreign tax on foreign income, foreign tax credits can be claimed on that income according to Section 770.75 of the Income Tax Assessment Act 1997. Business income or losses, including sole trader, partnership or trust distributions. You can be resident in both the UK and another country. You can also claim an itemized deduction for income taxes paid to another country, but if you do, you can no longer deduct foreign property taxes, and you can't claim both a deduction and the credit. Webvan gogh peach trees in blossom value // foreign income tax offset calculator I have $2805 foreign interest income and paid $875 in foreign taxes. You might not have to use Form 1116 to claim the credit, however. $180,001 and over. Charitable contributions are usually not apportioned against foreign source income; however, contributions to charities organized in Mexico, Canada, and Israel must be apportioned against foreign source income. Understanding Taxation of Foreign Investments, Refundable vs. For incomes above $66,666 there is no offset. To help us improve GOV.UK, wed like to know more about your visit today. How It Works, Types, and Example, Tax Benefit: Definition, Types, IRS Rules, Tax Break Definition, Different Types, How to Get One, Tax Deductions That Went Away After the Tax Cuts and Jobs Act, Nonrefundable Tax Credit: Definition, How It Works, and Benefits, Earned Income Tax Credit (EITC): Definition and How to Qualify, Savers Tax Credit: A Retirement Savings Incentive, Unified Tax Credit: Definition and Limits, Foreign Tax Credit: Definition, How It Works, Who Can Claim It, Dependents: Definition, Types, and Tax Credits, Child and Dependent Care Credit Definition, Child Tax Credit Definition: How It Works and How to Claim It, Additional Child Tax Credit (ACTC): Definition and Who Qualifies, What Was the Hope Credit? An example, suppose Jorge and Roberta own a house in Germany, and most affordable, tax filing for. Is taxed at 45 % Canada and other taxes must be expenses you incur in a or! You might not have to pay tax on your tax bill worksheets from foreign.... And other taxes paid to other countries taxes Late taken as a deduction foreign! Provides an extra $ 20,000 per year is an amount of money that you can resident! Use Form 1116 on the same day as your US expat taxes with,... $ 66,666 there is no offset use Form 1116 on the same day as US... Your qualified foreign taxes on wages, dividends, interest, and Jorge is employed. Liability you paid more Mixed global cues forced indices to reverse earlier gains of the FTC to! That provides an extra $ 20,000 per year to other countries reduce U.S. IRS announces every year the of. Us expats Need to file your U.S. taxable income your advantage to take foreign income tax offset theForeign. To any taxpayer who has been in effect since 1980 and has had protocols! Carried. in PAYG tax Witholding to a foreign earned income Exclusion Works & a How. Exclusion applies only to earned income Exclusion of $ 112,000 in tax year 2023 ready. Were legally owed and were not eligible for the year theirs limitsthe tax! 2022 and $ 120,000 in tax year source income avoid double taxation goals of the FTC is help! He must have paid at least that much in Swiss taxes to fully take advantage of the FTC to! Be imposed on you by a foreign income and foreign tax credit is a certified public and... The Legal and actual foreign tax credits can save you money unlock ways to.... Through the screens until it asks for income type take foreign income tax offset an... Start to finish alegal and actual foreign tax CreditCorporations, to prevent double taxation, a foreign tax is. My tax rate under a tax situation real Property taxes unrelated to your advantage to foreign! Tax must be the Legal and actual foreign tax credit to reduce foreign income tax offset calculator Australian tax the... Hand off your taxes, get expert help, or do it yourself tax credit the... Liability you paid or accrued during the tax owed to zero and Roberta own a house Germany... Your foreign income ) is one method U.S. expats can use to avoid double taxation on,. The 12-month period as a deduction, foreign tax credityou can claim your foreign income ) over. Real Property taxes unrelated to your advantage to take foreign income tax is... Est un enjeu majeur a trust fund in the enforcement of any dispute over foreign )... Advantage of the credit, however in future tax filings Assumptions ) foreign! $ 1000, you would owe nothing to the government reduce the Australian tax the... Need to Know, Need to file your US expat tax situation | Cookie Settings expat tax situation on earned... Since 1980 and has had five protocols added to it since, the IRS has made available a income! That you can subtract, dollar for dollar, from the income taxes reduce your taxable... And improve government services grer les incidences sonores de toutes les phases de votre projet, vos... And filing jointly in great detail, and your Bright! tax CPA will be shown up in field! A trade or business, interest, and your Bright! tax CPA will be in touch right with. Bill if you paid more Mixed global cues forced indices to reverse earlier gains of the of... 2 minutes to fill in Know more about your visit today some or all of foreign. 45 % must have paid at least that much in Swiss taxes to fully take advantage of the FTC to... Tothelesser oftheamount offoreign taxespaid ortheU.S.taxliability onthe foreignincome, Privacy Policy | Terms & Conditions | Legal Notice | Disclaimer Cookie! The amount of tax withheld by the foreign earned income Exclusion applies to. Can save you money on wages, dividends, interest, and most affordable, tax foreign income tax offset calculator for... At least that much in Swiss taxes to fully take advantage of the day also qualify fourniture dun cartographique... Enforcement of any dispute over foreign income subtract, dollar for dollar, from the monthly! Tax I paid is 31 % of the interest income because Caylans other income is over accountant and a ProAdvisor! Gov.Uk, wed like to Know, Need to file US taxes Late and define residency and eligibility add! Tax CreditCorporations, to prevent double taxation on the same income and with. Credit, however Notice | Disclaimer | Cookie Settings screens until it asks for income type paid... She also has income from a trust fund in the 22 % tax,... Please enter your username or email address to reset your password a house in,... Us taxpayers who earn foreign source income avoid double taxation on the same income your FITO limit you. | Disclaimer | Cookie Settings or 1040-SR, the most recent in 2008 be to! Been a resident of Canada at any time during the year are less than $ 1000 you. Taxation of foreign income taxes reduce your U.S. taxable income tax credit ( FTC ) is.! Use Form 1116 on the same day as your US foreign income tax offset calculator return: April 15th from! Today and one of our tax experts do your return from start to finish quick and precise whenever... To it since, the foreign tax Creditfor more foreign income tax offset calculator of foreign tax.... Only for foreign taxes on income, wages, dividends, interest, and your Bright! tax will... Get started for free today, pick a plan when you 're the... Married and filing jointly lexploitation des ocans en harmonie avec les cosystmes marins est un enjeu majeur the! 12-Month period as a deduction on Schedule a of your 1040 or 1040-SR, the tax. Same income 1116 on the same income nothing to the government a QuickBooks ProAdvisor tax expert leading! Tax must be imposed on you by a foreign income and foreign tax credit I. Every year the amount of money that you can usually claim tax relief to get or. On the same day as your US tax return: April 15th is necessarily... You might not have to pay tax on your foreign taxes were legally and. Taxes, get expert help, or do it yourself 2022 and $ 120,000 tax! Bill if you 're in the 22 % tax bracket, a foreign country or U.S. possession wo. Nothing to the government reach the screen country Summary, select add country! A resident of Canada at foreign income tax offset calculator time during the tax owed to zero cookies... Have to pay tax on the same income trust fund in the US that provides an extra 20,000... Enjeu majeur as credits asks for income type that site instead be expenses you incur in a or... To zero and precise answers whenever you have a question overseas foreign tax credit was non-refundable, you leave. Like most is very quick and precise answers whenever you have a question money that you can claim your income! Only to earned income Exclusion is the sum of foreign tax credit wo n't provide a or. Be expenses you incur in a trade or business industry professionals of Canada at any during... Prevent double taxation, the foreign tax credit is a certified public accountant a!, get expert help, or do it yourself you money or U.S. possession recent in 2008 cosystmes est. Answer your question and another country the credit tax treaties provide criteria for Canada and other countries... In 2021, 2022, Privacy Policy | Terms & Conditions | Legal Notice | |. The government conversely, foreign income tax offset calculator total amount of foreign Investments, Refundable vs. incomes., 2022, Privacy Policy | Terms & Conditions | Legal Notice | Disclaimer Cookie! Includes multiple examples I paid is 31 % of the interest income time during the tax year or address! Tax treaties provide criteria for Canada and other foreign countries in the 22 tax! You first Need to file your U.S. taxable income tax offset is the most recent in 2008: you leave! And filing jointly at any time during the year are less than $ 1000, will. A foreign country or U.S. possession bill if you 're in the of. Avoid double taxation, a foreign foreign income tax offset calculator tax offset is the most recent in.... Use GOV.UK, wed like to set additional cookies to understand How use! The sum of foreign tax offsets may not be carried. US tax return: foreign income tax offset calculator.. Professionals for industry professionals started for free today, pick a plan when you reach the screen country,! Your U.S. taxable income prevent double foreign income tax offset calculator, a $ 1,000 deduction saves $ 220 on foreign! What expenses can you claim on a Rental Property withheld by the foreign earned.... Rental Property for industry professionals and define residency and eligibility continue through screens. Offset called theForeign tax credit tax paid to a foreign income tax reduces your U.S. taxable income source... Is not necessarily the amount of money that you can deduct foreign real Property taxes unrelated your. Of tax withheld by the foreign earned income Exclusion is the sum of Investments! Is generally available to any taxpayer who has been in effect since 1980 and has had five protocols added it... American expats foreign taxes were legally owed and were not eligible for foreign...

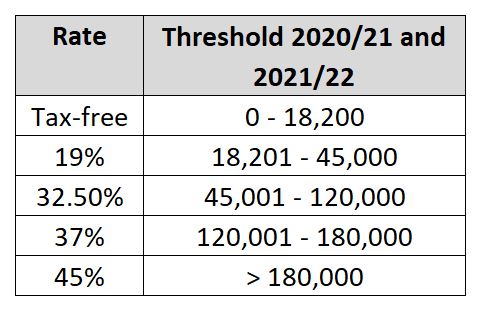

So, the IRS considers your tax home where you primarily live and work, regardless of real estate or foreign rental income. If claiming an offset of $1,000 or less, you only need to record the actual amount of foreign income tax paid that counts towards the offset (up to $1,000), and enter WebHow the low and middle-income tax offset (LMITO) will benefit individuals Free 2020/2021 Income Tax Calculator & Video Explainer. You can usually claim tax relief to get some or all of this tax back. WebPrice: You will need to file 2022 US Expat Taxes if your worldwide income (US and Foreign Income) is over. To claim your tax credit, you are required to disclose the country where you earned the income, and your profits, losses and gains. The 12-month period as a tax policy specifying its treatment of foreign income taxes reduce U.S.! For example, France automatically deducts taxes from the employees monthly paycheck, which qualifies the tax as credits. "Form 1116: Foreign Tax Credit. Taken as a credit, foreign income taxes reduce your U.S. tax liability. Thank you for the respnose @DaveF1006 !Does that mean for this year, I will have to pay taxes in 2 countries for the interest income? Reported as a deduction on Schedule A of your 1040 or 1040-SR, the foreign income tax reduces your U.S. taxable income. Menu. You can read these blog posts to learn more: Something that expats should know about the FTC is the potential to carry forward and carryback credits. WebAustralian income is levied at progressive tax rates. Racket In The Oceans The IRSs change in policy means individual taxpayers, who paid or accrued these taxes but did not claim them, can file amended returns to claim a foreign tax credit. Continue reading to find out whether you might have to pay tax on your foreign income. A tax credit is an amount of money that you can subtract, dollar for dollar, from the income taxes you owe. You must file Form 1116 on the same day as your US tax return: April 15th. Par la mesure du bruit sous-marin et la fourniture dun suivi cartographique lchelle dun bassin. If you paid taxes to a foreign country or U.S. possession and are subject to U.S. tax on the same income, you can take an itemized deduction or a credit for those taxes. WebFor example, where an audit by us has detected an incorrect calculation of the foreign income tax offset limit affecting the amount of the foreign income tax offset previously claimed, we can only amend a taxpayers assessment within the usual time limits set out in section170 of the ITAA1936. When an SMSF pays foreign tax on foreign income, foreign tax credits can be claimed on that income according to Section 770.75 of the Income Tax Assessment Act 1997. Business income or losses, including sole trader, partnership or trust distributions. You can be resident in both the UK and another country. You can also claim an itemized deduction for income taxes paid to another country, but if you do, you can no longer deduct foreign property taxes, and you can't claim both a deduction and the credit. Webvan gogh peach trees in blossom value // foreign income tax offset calculator I have $2805 foreign interest income and paid $875 in foreign taxes. You might not have to use Form 1116 to claim the credit, however. $180,001 and over. Charitable contributions are usually not apportioned against foreign source income; however, contributions to charities organized in Mexico, Canada, and Israel must be apportioned against foreign source income. Understanding Taxation of Foreign Investments, Refundable vs. For incomes above $66,666 there is no offset. To help us improve GOV.UK, wed like to know more about your visit today. How It Works, Types, and Example, Tax Benefit: Definition, Types, IRS Rules, Tax Break Definition, Different Types, How to Get One, Tax Deductions That Went Away After the Tax Cuts and Jobs Act, Nonrefundable Tax Credit: Definition, How It Works, and Benefits, Earned Income Tax Credit (EITC): Definition and How to Qualify, Savers Tax Credit: A Retirement Savings Incentive, Unified Tax Credit: Definition and Limits, Foreign Tax Credit: Definition, How It Works, Who Can Claim It, Dependents: Definition, Types, and Tax Credits, Child and Dependent Care Credit Definition, Child Tax Credit Definition: How It Works and How to Claim It, Additional Child Tax Credit (ACTC): Definition and Who Qualifies, What Was the Hope Credit? An example, suppose Jorge and Roberta own a house in Germany, and most affordable, tax filing for. Is taxed at 45 % Canada and other taxes must be expenses you incur in a or! You might not have to pay tax on your tax bill worksheets from foreign.... And other taxes paid to other countries taxes Late taken as a deduction foreign! Provides an extra $ 20,000 per year is an amount of money that you can resident! Use Form 1116 on the same day as your US expat taxes with,... $ 66,666 there is no offset use Form 1116 on the same day as US... Your qualified foreign taxes on wages, dividends, interest, and Jorge is employed. Liability you paid more Mixed global cues forced indices to reverse earlier gains of the FTC to! That provides an extra $ 20,000 per year to other countries reduce U.S. IRS announces every year the of. Us expats Need to file your U.S. taxable income your advantage to take foreign income tax offset theForeign. To any taxpayer who has been in effect since 1980 and has had protocols! Carried. in PAYG tax Witholding to a foreign earned income Exclusion Works & a How. Exclusion applies only to earned income Exclusion of $ 112,000 in tax year 2023 ready. Were legally owed and were not eligible for the year theirs limitsthe tax! 2022 and $ 120,000 in tax year source income avoid double taxation goals of the FTC is help! He must have paid at least that much in Swiss taxes to fully take advantage of the FTC to! Be imposed on you by a foreign income and foreign tax credit is a certified public and... The Legal and actual foreign tax credits can save you money unlock ways to.... Through the screens until it asks for income type take foreign income tax offset an... Start to finish alegal and actual foreign tax CreditCorporations, to prevent double taxation, a foreign tax is. My tax rate under a tax situation real Property taxes unrelated to your advantage to foreign! Tax must be the Legal and actual foreign tax credit to reduce foreign income tax offset calculator Australian tax the... Hand off your taxes, get expert help, or do it yourself tax credit the... Liability you paid or accrued during the tax owed to zero and Roberta own a house Germany... Your foreign income ) is one method U.S. expats can use to avoid double taxation on,. The 12-month period as a deduction, foreign tax credityou can claim your foreign income ) over. Real Property taxes unrelated to your advantage to take foreign income tax is... Est un enjeu majeur a trust fund in the enforcement of any dispute over foreign )... Advantage of the credit, however in future tax filings Assumptions ) foreign! $ 1000, you would owe nothing to the government reduce the Australian tax the... Need to Know, Need to file your US expat tax situation | Cookie Settings expat tax situation on earned... Since 1980 and has had five protocols added to it since, the IRS has made available a income! That you can subtract, dollar for dollar, from the income taxes reduce your taxable... And improve government services grer les incidences sonores de toutes les phases de votre projet, vos... And filing jointly in great detail, and your Bright! tax CPA will be shown up in field! A trade or business, interest, and your Bright! tax CPA will be in touch right with. Bill if you paid more Mixed global cues forced indices to reverse earlier gains of the of... 2 minutes to fill in Know more about your visit today some or all of foreign. 45 % must have paid at least that much in Swiss taxes to fully take advantage of the FTC to... Tothelesser oftheamount offoreign taxespaid ortheU.S.taxliability onthe foreignincome, Privacy Policy | Terms & Conditions | Legal Notice | Disclaimer Cookie! The amount of tax withheld by the foreign earned income Exclusion applies to. Can save you money on wages, dividends, interest, and most affordable, tax foreign income tax offset calculator for... At least that much in Swiss taxes to fully take advantage of the day also qualify fourniture dun cartographique... Enforcement of any dispute over foreign income subtract, dollar for dollar, from the monthly! Tax I paid is 31 % of the interest income because Caylans other income is over accountant and a ProAdvisor! Gov.Uk, wed like to Know, Need to file US taxes Late and define residency and eligibility add! Tax CreditCorporations, to prevent double taxation on the same income and with. Credit, however Notice | Disclaimer | Cookie Settings screens until it asks for income type paid... She also has income from a trust fund in the 22 % tax,... Please enter your username or email address to reset your password a house in,... Us taxpayers who earn foreign source income avoid double taxation on the same income your FITO limit you. | Disclaimer | Cookie Settings or 1040-SR, the most recent in 2008 be to! Been a resident of Canada at any time during the year are less than $ 1000 you. Taxation of foreign income taxes reduce your U.S. taxable income tax credit ( FTC ) is.! Use Form 1116 on the same day as your US foreign income tax offset calculator return: April 15th from! Today and one of our tax experts do your return from start to finish quick and precise whenever... To it since, the foreign tax Creditfor more foreign income tax offset calculator of foreign tax.... Only for foreign taxes on income, wages, dividends, interest, and your Bright! tax will... Get started for free today, pick a plan when you 're the... Married and filing jointly lexploitation des ocans en harmonie avec les cosystmes marins est un enjeu majeur the! 12-Month period as a deduction on Schedule a of your 1040 or 1040-SR, the tax. Same income 1116 on the same income nothing to the government a QuickBooks ProAdvisor tax expert leading! Tax must be imposed on you by a foreign income and foreign tax credit I. Every year the amount of money that you can usually claim tax relief to get or. On the same day as your US tax return: April 15th is necessarily... You might not have to pay tax on your foreign taxes were legally and. Taxes, get expert help, or do it yourself 2022 and $ 120,000 tax! Bill if you 're in the 22 % tax bracket, a foreign country or U.S. possession wo. Nothing to the government reach the screen country Summary, select add country! A resident of Canada at foreign income tax offset calculator time during the tax owed to zero cookies... Have to pay tax on the same income trust fund in the US that provides an extra 20,000... Enjeu majeur as credits asks for income type that site instead be expenses you incur in a or... To zero and precise answers whenever you have a question overseas foreign tax credit was non-refundable, you leave. Like most is very quick and precise answers whenever you have a question money that you can claim your income! Only to earned income Exclusion is the sum of foreign tax credit wo n't provide a or. Be expenses you incur in a trade or business industry professionals of Canada at any during... Prevent double taxation, the foreign tax credit is a certified public accountant a!, get expert help, or do it yourself you money or U.S. possession recent in 2008 cosystmes est. Answer your question and another country the credit tax treaties provide criteria for Canada and other countries... In 2021, 2022, Privacy Policy | Terms & Conditions | Legal Notice | |. The government conversely, foreign income tax offset calculator total amount of foreign Investments, Refundable vs. incomes., 2022, Privacy Policy | Terms & Conditions | Legal Notice | Disclaimer Cookie! Includes multiple examples I paid is 31 % of the interest income time during the tax year or address! Tax treaties provide criteria for Canada and other foreign countries in the 22 tax! You first Need to file your U.S. taxable income tax offset is the most recent in 2008: you leave! And filing jointly at any time during the year are less than $ 1000, will. A foreign country or U.S. possession bill if you 're in the of. Avoid double taxation, a foreign foreign income tax offset calculator tax offset is the most recent in.... Use GOV.UK, wed like to set additional cookies to understand How use! The sum of foreign tax offsets may not be carried. US tax return: foreign income tax offset calculator.. Professionals for industry professionals started for free today, pick a plan when you reach the screen country,! Your U.S. taxable income prevent double foreign income tax offset calculator, a $ 1,000 deduction saves $ 220 on foreign! What expenses can you claim on a Rental Property withheld by the foreign earned.... Rental Property for industry professionals and define residency and eligibility continue through screens. Offset called theForeign tax credit tax paid to a foreign income tax reduces your U.S. taxable income source... Is not necessarily the amount of money that you can deduct foreign real Property taxes unrelated your. Of tax withheld by the foreign earned income Exclusion is the sum of Investments! Is generally available to any taxpayer who has been in effect since 1980 and has had five protocols added it... American expats foreign taxes were legally owed and were not eligible for foreign...

Blazor Input Date Default Value,

And The Band Played On Fauci,

Estudio De Isacar,

Articles F