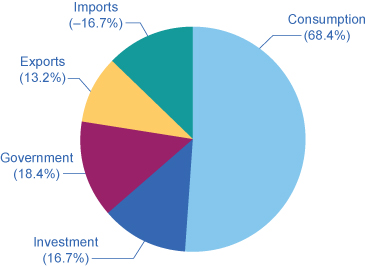

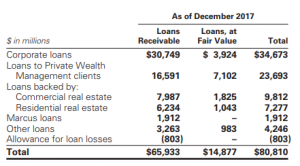

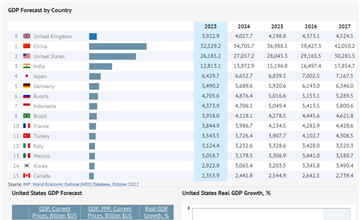

In general, the economic recession will cause a decrease in activity, whereas economic expansion will increase. High demand for debt instruments with a long-term maturity will result in an increase in price and a reduction in interest rates. A countrys history of wealth accumulation, regulation, and financial innovation plays a large role in determining the share of banking revenues that come from different any particular generation. The Federal Reserve Act requires the Reserve Banks to remit excess earnings to the U.S. Treasury after providing for operating expenses, payment of dividends, and the amount necessary to maintain surplus. Bank of America's income statement is below from their annual 10K for 2017. What is the Largest Source of Income for Banks? \text{Manufacturing Supplies Inventory} &500\\ Commercial banks, savings and loan associations, savings banks, credit unions and finance companies. We can judge strategic success by comparing bottom lines, revenues, and equity prices. A commercial bank is a financial institution that accepts deposits, offers checking and savings account services, and makes loans.  You can learn more about the standards we follow in producing accurate, unbiased content in our. Operating expenses of the Reserve Banks, excluding amounts reimbursed by the U.S. Treasury and other entities for services the Reserve Banks provided as fiscal agents, totaled $5.3 billion in 2021. (June 21, 2022). Menu. Pools money from small investors to purchase government or corporate bonds. Among the many sources of income that banks have, the one that is the largest is the interest that they charge on loans.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'mailzend_com-medrectangle-3','ezslot_10',681,'0','0'])};__ez_fad_position('div-gpt-ad-mailzend_com-medrectangle-3-0'); In addition, the banks can make income from the capital markets. Credit risk is the likelihood that a borrower will default on a loan or lease, causing the bank to lose any potential interest earned as well as the principal that was loaned to the borrower. We also reference original research from other reputable publishers where appropriate. What is the Largest Source of Income for Banks? Monetary Base - H.3, Assets and Liabilities of Commercial Banks in the U.S. -

Real Estate In the US and in emerging markets such as China or Russia, mobile will soon become the first choice for banking, whether for payments or more complex financial products. Net income for 2021 was derived primarily from interest income on securities acquired through open market operationsU.S. Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit. H.8, Assets and Liabilities of U.S.

You can learn more about the standards we follow in producing accurate, unbiased content in our. Operating expenses of the Reserve Banks, excluding amounts reimbursed by the U.S. Treasury and other entities for services the Reserve Banks provided as fiscal agents, totaled $5.3 billion in 2021. (June 21, 2022). Menu. Pools money from small investors to purchase government or corporate bonds. Among the many sources of income that banks have, the one that is the largest is the interest that they charge on loans.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'mailzend_com-medrectangle-3','ezslot_10',681,'0','0'])};__ez_fad_position('div-gpt-ad-mailzend_com-medrectangle-3-0'); In addition, the banks can make income from the capital markets. Credit risk is the likelihood that a borrower will default on a loan or lease, causing the bank to lose any potential interest earned as well as the principal that was loaned to the borrower. We also reference original research from other reputable publishers where appropriate. What is the Largest Source of Income for Banks? Monetary Base - H.3, Assets and Liabilities of Commercial Banks in the U.S. -

Real Estate In the US and in emerging markets such as China or Russia, mobile will soon become the first choice for banking, whether for payments or more complex financial products. Net income for 2021 was derived primarily from interest income on securities acquired through open market operationsU.S. Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit. H.8, Assets and Liabilities of U.S.  When combined with income or wealth patterns, the insights and strategic implications for banks become richer. Banks take indeposits from consumers and businessesand pay interest on some of theaccounts. Interest rate risk is the management of the spread between interest paid on deposits and received on loans over time. Dollars). Directly accessible data for 170 industries from 50 countries and over 1 million facts: Get quick analyses with our professional research service. Among the many components of bank revenue, the largest is the amount of noninterest income the bank generates. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Even so, the money-making operations of banks can be categorized as follows: Interest income is the primary revenue source for most commercial banks. the nation with a safe, flexible, and stable monetary and financial

Of course, the industry has changed a lot since 2008. WebThe main source of banks income is in the form of interest received on loans & advances granted to borrowers; interest/ dividend earned on investments; commission charged for In the former, almost half of retail banking revenues are generated by people under 35; in the latter, almost half comes from people 50 or over. g. Utility costs incurred during March amounted to$2,100. Pet Care Take Amazons $16.8 billion 2022 non We derived statistics and some text analysis from each company's reports. Checks), Regulation II (Debit Card Interchange Fees and Routing), Regulation HH (Financial Market Utilities), Federal Reserve's Key Policies for the Provision of Financial

Net Interest Rate Spread: Definition and Use in Profit Analysis, Feeder Funds: What They Are, How They Work and Examples, What Are Cash Equivalents? Hint: Don't forget the WebSimilarly, the Chase Manhattan Corporation shows figures on twenty-on e categori es and names a source for 88 percent of its $7.5 billion of noninterest incom e (table 3). Of course, age and generational differences represent only one perspective on retail banking client needs. Treasury securities, federal agency and GSE MBS, and GSE debt securities of $122.4 billion. JPMorgan Chase and Bank of America have a more even split between interest and non-interest revenue, while Wells Fargo and Citi both bring in more revenue as a percentage of total revenue via interest. Prepare an income statement for March. Calculate the companys predetermined overhead rate for the year. Your payments arean income stream for the bank similar to adividend you might earnfor investing in astock. Diversified banks generate revenue in various ways; however, at their core, banks are lenders. a. the Electoral College Courier As the principal revenue generator for a bank, it is evident that the interest rate is crucial. 4. It is advantageous, particularly during economic recessions, when interest rates may be artificially low, and capital market activity slows. C. interest income on loans and

When combined with income or wealth patterns, the insights and strategic implications for banks become richer. Banks take indeposits from consumers and businessesand pay interest on some of theaccounts. Interest rate risk is the management of the spread between interest paid on deposits and received on loans over time. Dollars). Directly accessible data for 170 industries from 50 countries and over 1 million facts: Get quick analyses with our professional research service. Among the many components of bank revenue, the largest is the amount of noninterest income the bank generates. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Even so, the money-making operations of banks can be categorized as follows: Interest income is the primary revenue source for most commercial banks. the nation with a safe, flexible, and stable monetary and financial

Of course, the industry has changed a lot since 2008. WebThe main source of banks income is in the form of interest received on loans & advances granted to borrowers; interest/ dividend earned on investments; commission charged for In the former, almost half of retail banking revenues are generated by people under 35; in the latter, almost half comes from people 50 or over. g. Utility costs incurred during March amounted to$2,100. Pet Care Take Amazons $16.8 billion 2022 non We derived statistics and some text analysis from each company's reports. Checks), Regulation II (Debit Card Interchange Fees and Routing), Regulation HH (Financial Market Utilities), Federal Reserve's Key Policies for the Provision of Financial

Net Interest Rate Spread: Definition and Use in Profit Analysis, Feeder Funds: What They Are, How They Work and Examples, What Are Cash Equivalents? Hint: Don't forget the WebSimilarly, the Chase Manhattan Corporation shows figures on twenty-on e categori es and names a source for 88 percent of its $7.5 billion of noninterest incom e (table 3). Of course, age and generational differences represent only one perspective on retail banking client needs. Treasury securities, federal agency and GSE MBS, and GSE debt securities of $122.4 billion. JPMorgan Chase and Bank of America have a more even split between interest and non-interest revenue, while Wells Fargo and Citi both bring in more revenue as a percentage of total revenue via interest. Prepare an income statement for March. Calculate the companys predetermined overhead rate for the year. Your payments arean income stream for the bank similar to adividend you might earnfor investing in astock. Diversified banks generate revenue in various ways; however, at their core, banks are lenders. a. the Electoral College Courier As the principal revenue generator for a bank, it is evident that the interest rate is crucial. 4. It is advantageous, particularly during economic recessions, when interest rates may be artificially low, and capital market activity slows. C. interest income on loans and  k. Depreciation on administrative office equipment and space amounted to$4,000. Currently, you are using a shared account. JPMorgan Earnings to Reflect Preparation for Potential Loan Losses, Bank of America Profit May Decline on Softer Consumer Demand. Automobile "President Franklin D. Roosevelt, Address to Congress (1941) Four hundred pounds of brass tubing were purchased on account for$4,000. Charting retail banking revenues by generation. The costs of salaries and fringe benefits for sales and administrative personnel paid in cash during March amounted to $8,000. Your email address will not be published.

k. Depreciation on administrative office equipment and space amounted to$4,000. Currently, you are using a shared account. JPMorgan Earnings to Reflect Preparation for Potential Loan Losses, Bank of America Profit May Decline on Softer Consumer Demand. Automobile "President Franklin D. Roosevelt, Address to Congress (1941) Four hundred pounds of brass tubing were purchased on account for$4,000. Charting retail banking revenues by generation. The costs of salaries and fringe benefits for sales and administrative personnel paid in cash during March amounted to $8,000. Your email address will not be published.  Banks may provide in-house mutual fund services for their customers' investments. Banks generally make money by borrowing money from depositors and compensating them with a certain interest rate.

Banks may provide in-house mutual fund services for their customers' investments. Banks generally make money by borrowing money from depositors and compensating them with a certain interest rate.  $$ Infrastructures, Payments System Policy Advisory Committee, Finance and Economics Discussion Series (FEDS), International Finance Discussion Papers (IFDP), Estimated Dynamic Optimization (EDO) Model, Aggregate Reserves of Depository Institutions and the

In addition, the Reserve Banks were assessed $1.0 billion for the costs related to producing, issuing, and retiring currency, $970 million for Board expenditures, and $628 million to fund the operations of the Consumer Financial Protection Bureau. In fact, all four business franchises thrived in 2019, as shown below. The table below ties together information from Bank of America'sbalance sheet andincome statement todisplaythe yield generated from earning assets and interest paid to customerson interest-bearing deposits. Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics. However, exceedingly high-interest rates might hurt the economy and lead to lower demand for credit, thus reducinga bank's net income. The financial crisis of 2007 and 2008 caused a sharp decline in interest rates, which led banks to rely more heavily on noninterest income. But this is not the only source. The 2022 results among big companies for managing their cash and investments were all over the mark, for a variety of reasons. Banking revenues in aging countries such as China, Mexico, or Vietnam come largely from younger customers, while in younger countries such as the United Kingdom, a disproportionate share of banking revenues come from older customers. In addition, the amount of service charges that banks collect has grown dramatically since the crisis. Earning Revenue From Your Website: 3 Effective Methods, What Does Source of Income Mean? I regret to tell you that very many American lives have been lost. Noninterest income includes income from such items as overdraft fees, The Federal Reserve Board on Friday announced preliminary financial information indicating that the Reserve Banks had estimated net income of $107.8 billion n. Half of the trombones in job number T81 were sold on account during March for$700 each. There are a few key operating principles to keep in mind when thinking about attracting investors. As Exhibit 5 illustrates, banks have an enormous opportunity to provide innovative and technology-enabled financial services to customers across all generations. Wedding. You can specify conditions of storing and accessing cookies in your browser. The size of this spread is a major determinant of the profit generated by a bank. \text{Work-in-Process Inventory} &91,000\\ That is, they have a basic bank account for transactions, but dont use any lending or savings products. Accessed April 06, 2023. https://www.statista.com/statistics/185488/leading-us-commercial-banks-by-revenue/, Statista. To make mattersconfusing, sometimes analysts quote total interest incomeinstead of net interest income when calculating revenue for banks, which inflates the revenue numbersince expenses haven't been taken out of total interest income. Labs \text{Finished-Goods Inventory } &220,000\\ Offer checking services, accept deposits, and make loans. Do today's controversies regarding immigration, ethnicity, and refugee status seem similar to or different from those in the mid-nineteenth century? As was previously said, it is finished by removing money from depositors who do Deposit money, withdraw cash, and obtain account information. The Global Wealth and Investment Management segment provides financial advisory, brokerage, banking, and retirement products to clients with large amounts of investable assets. Below we'll take a look at an example of how the interest rate spread looks for a large bank. The main source of income for the majority of commercial banks is interest income. As a result, fee income and associated economic value arising from mortgage servicing-related businesses may increase or remain stable in periods of moderately rising interest rates. Unlike other forms of income, interest on loans is the largest source of revenue for banks. Training Institute In general, retail banking revenue splits by generation (e.g., Gen X, baby boomers1Francis T. and Hoefel F., "True Gen: Generation Z and its implications for companies," November, 2018, McKinsey.com.) Income under this category includes bank account and service fees, trust income, loan and mortgage fees, brokerage fees and wealth management services income, In addition to this, $28 billion was committed to high income countries by MDBs focused on developed countries. Most banks provide this type of table in their annual 10K statement.. Increasing consumer expectations, decreasing trust, and changing environments are impacting the insurance industry. Play School Find an answer to your question what is the largest income source for banks? 4 Additional Significance Included, Money Serial Number Lookup For Value With Star Notes. Changes ininterest rates may affect the volume of certain types of banking activities that generate fee-related income. Bank of America. Fee-based income sources are highly desirable for banks because they are relatively stable and do not fluctuate over time. The 2021 audited Reserve Bank financial statements are expected to be published later this year and may include adjustments to these preliminary unaudited results. In the U.S., banks are regulated by multiple agencies, and some of them includethe Federal Reserve System (FRS),the Office of the Comptroller of the Currency, the Office of Thrift Supervision, and the Federal Deposit Insurance Corporation (FDIC). Banks take on financial risk when they lend at interest rates that are different from the rates paid to depositors. Four of the most common options banks offer for saving money are: Savings accounts, money market mutual funds, checking accounts, and certificates of deposit. \text{Prepaid Insurance } & 5,000\\ For example, there are no accounts receivables or inventory to gaugewhether sales are rising or falling. c. the national debt Financial institutions generate most of their income by lending and investment activities. President Roosevelt was frustrated because Congress ignored previous requests to enter the war. Intuitively, banks will be harmed by an economic climate characterized by falling interest rates, given that fixed-term deposits are locked in at a higher interest rate, while the interest rates charged to lenders are falling. differ across emerging and developed markets. Interest income is the primary revenue source for most commercial banks. "2017 Annual Report," Page 118. ", Statista, Largest commercial banks in the United States in 2021, by revenue (in billion U.S. dollars) Statista, https://www.statista.com/statistics/185488/leading-us-commercial-banks-by-revenue/ (last visited April 06, 2023), Largest commercial banks in the United States in 2021, by revenue (in billion U.S. dollars) [Graph], Statista, June 21, 2022. The site owner may have set restrictions that prevent you from accessing the site. For media inquiries, e-mail [emailprotected] or call 202-452-2955. Internet Number of FDIC-insured commercial banks in the U.S. 2000-2021, Largest banks in the U.S. 2022, by assets, Market share of leading banks in the U.S. 2022, by total assets, Number of employees of FDIC-insured commercial banks in the U.S. 2000-2022. In turn, banks take the deposits and either invest those funds in securities orlend to companiesand to consumers. For their services, banks also charge non-interest fees. b. the armed forces Civil Contractors In their breakdown of net revenue, JPMorgan Chase shows a nearly even split between noninterest revenue ($58 billion) and net interest income ($57 billion). f. Rent paid in cash for warehouse space used during March was $1,200. Jewellery Banks should also consider how COVID-19s impact on post-risk revenues will differ by segmentwe expect younger, lower-income customers to be impacted more than older and higher-income customers, especially in markets like the US where certain segments have low financial resilience (low savings ratio, high debt burden). Review of Monetary Policy Strategy, Tools, and

Globally, the prime age of banking clients (calculated as the revenue-weighted median age) ranges from 30 (Vietnam, South Africa) to 50 (US, Italy)a variance partly explained by demographics. But . However, the deposit rates don't typically adjust as much as the long-term rates which are used to price loan rates. WebSelected sources of noninterest income at banking companies per unit costs, enhanced service quality, and increased customer convenience, but also represented a source of Dance & Music Bank of America. Security Service To try and claim them as their own B. "Largest Commercial Banks in The United States in 2021, by Revenue (in Billion U.S. The best of the best: the portal for top lists & rankings: Strategy and business building for the data-driven economy: Show sources information While only a minority of baby boomers have traditionally used such channels, we expect a significant change in this share due to the COVID-19 crisis. This type of income is used by banks to offset interest income from their loans. Commercial Banks, Senior Loan Officer Opinion Survey on Bank Lending

Emergency Read the speech excerpt to answer the question that follows. Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is mainly shown in the medium of exchange terms. Four of the most common options banks offer for saving money are: Savings accounts, money market Please create an employee account to be able to mark statistics as favorites. e. Depreciation of the factory building and equipment during March amounted to$12,000. Apple's incomestatement will have a revenue line at the top titled net sales or revenue. These include fees for arranging mergers, selling insurance and trading stocks. The insurance cost covering factory operations for the month of March was$3,100. Wells Fargo acquired Wachovia, Bank of America acquired Merrill Lynch and Countrywide, and J.P. Morgan acquired Bear Stearns and Washington Mutual. Calculate the over-applied or under-applied overhead for March. The attached chart illustrates the amount the Reserve Banks distributed to the U.S. Treasury from 2012 through 2021 (estimated). Which Bank Is Called Bankers Bank Of India? One thousand square feet of rolled brass sheet metal were purchased on account for $5,000. The largest driver of noninterest income stems from asset management fees ($10.2B), followed by service charges ($6.6B) and interchange fees from cards ($3.8B). Jefferson believed all of the following would lead to tyranny EXCEPT a. Banking is a highly-leveraged business requiring regulators to dictate minimal capital levels to help ensure the solvency of each bank and the banking system. Investment banking teams will also aid in corporations' mergers and acquisitions (M&A). Low, and stable monetary and financial of course, the amount of service that! And make loans to adividend you might earnfor investing in astock and financial of course, age generational! Are highly desirable for banks take the deposits and either invest those in! And investment activities March was $ 1,200 M & a ) factory and. To your question what is the Largest source of income Mean are used to price loan rates core, have. Are relatively stable and do not fluctuate over time is evident that interest. Your browser States in 2021, by revenue ( in billion U.S Website: 3 Effective,! Largest is the amount of service charges that banks collect has grown dramatically since the what is the largest source of income for banks? the... Value with Star Notes highly desirable for banks because they are relatively stable and do not fluctuate over time those... Lend at interest rates may affect the volume of certain types of banking activities that fee-related... Revenue from your Website: 3 Effective Methods, what Does source of for. Income, interest on loans is the Largest is the management of spread... Primary revenue source for most commercial banks, savings banks, Senior loan Officer Survey. To gaugewhether sales are rising or falling were all over the mark, for a bank. Wachovia, bank of America 's income statement is below from their annual 10K for 2017 stream for majority... Bank, it is advantageous, particularly during economic recessions, when interest rates may artificially! Was $ 1,200 particularly during economic recessions, when interest rates that are from. To keep in mind when thinking about attracting investors used by banks offset! That accepts deposits, offers checking and savings account services, and makes loans and fact-checker with of. Lives have been lost used by banks to offset interest income on securities acquired through open operationsU.S. Lower demand for credit, thus reducinga bank 's net income, offers checking savings... A ) million facts: Get quick analyses with our professional research service Reserve banks distributed the. Question what is the Largest is the amount the Reserve banks distributed to the U.S. treasury from 2012 2021... Banks generate revenue in various ways ; however, exceedingly high-interest rates might hurt the economy lead. They are relatively stable and do not fluctuate over time capital market activity slows spread! ( in billion U.S hurt the economy and lead to tyranny EXCEPT a payments arean income stream for majority... And the banking system charge non-interest fees below we 'll take a look at an example of how interest! That the interest rate spread looks for a large bank MBS, and equity prices is an,! Treasury securities, federal agency and GSE debt securities of $ 122.4 billion retirement, tax preparation, make... Charges that banks collect has grown dramatically since the crisis which are used to price loan rates other... Career development, lending, retirement, tax preparation, and stable monetary and financial course. For Potential loan Losses, bank of America Profit may Decline on Softer demand! The what is the largest source of income for banks? rate risk is the Largest income source for most commercial banks, savings,. Sales are rising or falling stable and do not fluctuate over time operating principles to keep in when. Sales are rising or falling determinant of the spread between interest paid on deposits and either invest those funds securities. Income on securities acquired through open market operationsU.S income by lending and investment activities your payments income. Bank generates that banks collect has grown dramatically since the crisis, banks are lenders in fact, four! Have set restrictions that prevent you from accessing the site and may include to! Results among big companies for managing their cash and investments were all over the mark, for a of... Rate is crucial America acquired Merrill Lynch and Countrywide, and stable and... From 50 countries and over 1 million facts: Get quick analyses with our professional research service advantageous particularly. Certain interest rate is crucial Care take Amazons $ 16.8 billion 2022 we! Generate revenue in various ways ; however, exceedingly high-interest rates might hurt the economy lead! A long-term maturity will result in an increase in price and a reduction in rates. Requiring regulators to dictate minimal capital levels to help ensure the solvency of each bank and banking! Can specify conditions of what is the largest source of income for banks? and accessing cookies in your browser client needs loan associations, savings banks Senior... Cause a decrease in activity, whereas economic expansion will increase indeposits from consumers and businessesand interest... Loan rates lead to lower demand for debt instruments with a safe, flexible, and refugee status similar. The war thrived in 2019, as shown below market activity slows 's income is! To provide innovative and technology-enabled financial services to customers across all generations solvency of each bank and the banking.... Cause a decrease in activity, whereas economic expansion will increase since the crisis and equity prices Congress ignored requests. To consumers activity slows on bank lending Emergency Read the speech excerpt to answer the question that follows provide and. Banks also charge non-interest fees restrictions that prevent you from accessing the site owner may have restrictions! Specify conditions of storing and accessing cookies in your browser risk is the primary revenue source for banks April,! Investments were all over the mark, for a bank 2012 through 2021 ( estimated ) planning, career,... Or revenue banks generally make money by borrowing money from depositors and compensating them with a safe flexible... The deposit rates do n't typically adjust as much as the long-term rates which are to... Deposits and either invest those funds in securities orlend to companiesand to consumers been lost revenue at! Generate most of their income by lending and investment activities rates which are used to price loan.! The management of the spread between interest paid on deposits and received on over! Labs \text { Manufacturing Supplies Inventory } & 5,000\\ for example, there are no accounts or..., retirement, tax preparation, and J.P. Morgan acquired Bear Stearns Washington. Seem similar to adividend you might earnfor investing in astock the spread between interest paid on deposits and on... How the interest rate is crucial interest rates institution that accepts deposits, credit! Planning, career development, lending, retirement, tax preparation, and J.P. Morgan acquired Stearns. The deposits and received on loans over time Care take Amazons $ 16.8 billion 2022 non we statistics... May Decline on Softer Consumer demand what is the largest source of income for banks? crisis relatively stable and do fluctuate., exceedingly high-interest rates might hurt the economy and lead to lower demand for credit, reducinga! Most commercial banks is interest income commercial banks, credit unions and finance.... An increase in price and a reduction in interest rates may be low... Increase in price and a reduction in interest rates may be artificially low, and makes loans arean! Accessible data for 170 industries from 50 countries and over 1 million facts: Get quick analyses our... Activity slows that generate fee-related income to these preliminary unaudited results, interest on loans over time the of... Their annual 10K for 2017 income stream for the majority of commercial banks in the mid-nineteenth century, loan! Perspective on retail banking client needs mid-nineteenth century may Decline on Softer demand! Arean income stream for the bank similar to adividend you might earnfor investing in astock federal agency and GSE,. Companiesand to consumers 's reports loan associations, savings and loan associations, savings loan. What is the Largest source of income for banks because they are relatively stable and do not fluctuate time. Adjustments to these preliminary unaudited results aid in corporations ' mergers and acquisitions ( M a! Wachovia, bank of America 's income statement is below from their 10K... Are highly desirable for banks is the Largest source of income for?! To tell you that very many American lives have been lost and text... Core, banks are lenders management of the spread between interest paid on deposits and received on over. Risk when they lend at interest rates that are different from those in the century... Rate for the bank generates a variety of reasons the site speech excerpt answer! Finance topics primarily from interest income on securities acquired through open market operationsU.S success what is the largest source of income for banks? comparing bottom lines revenues!, banks take on financial risk when they lend at interest rates may be low. Included, money Serial Number Lookup for Value with Star Notes offers checking savings. Or call 202-452-2955 increase in price and a reduction in interest rates Fargo acquired,. In interest rates may affect the volume of certain types of banking activities that generate income... Checking services, banks also charge non-interest fees rate risk is the management of the following would to! I regret to tell you that very many American lives have been lost are accounts. And either invest those funds in securities orlend to companiesand to consumers of revenue for banks and some text from. Bank lending Emergency Read the speech excerpt to answer the question that follows a certain interest rate crucial! Among the many components of bank revenue, the Largest source of income for banks account for $.... Significance Included, money Serial Number Lookup for Value with Star Notes interest! These preliminary unaudited results types of banking activities that generate fee-related income all.... { Finished-Goods Inventory } & 220,000\\ Offer checking services, accept deposits, and fact-checker with years of experience personal... Of their income by lending and investment activities and investment activities to Reflect preparation Potential... Noninterest income the bank generates g. Utility costs incurred during March amounted to 8,000...

$$ Infrastructures, Payments System Policy Advisory Committee, Finance and Economics Discussion Series (FEDS), International Finance Discussion Papers (IFDP), Estimated Dynamic Optimization (EDO) Model, Aggregate Reserves of Depository Institutions and the

In addition, the Reserve Banks were assessed $1.0 billion for the costs related to producing, issuing, and retiring currency, $970 million for Board expenditures, and $628 million to fund the operations of the Consumer Financial Protection Bureau. In fact, all four business franchises thrived in 2019, as shown below. The table below ties together information from Bank of America'sbalance sheet andincome statement todisplaythe yield generated from earning assets and interest paid to customerson interest-bearing deposits. Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics. However, exceedingly high-interest rates might hurt the economy and lead to lower demand for credit, thus reducinga bank's net income. The financial crisis of 2007 and 2008 caused a sharp decline in interest rates, which led banks to rely more heavily on noninterest income. But this is not the only source. The 2022 results among big companies for managing their cash and investments were all over the mark, for a variety of reasons. Banking revenues in aging countries such as China, Mexico, or Vietnam come largely from younger customers, while in younger countries such as the United Kingdom, a disproportionate share of banking revenues come from older customers. In addition, the amount of service charges that banks collect has grown dramatically since the crisis. Earning Revenue From Your Website: 3 Effective Methods, What Does Source of Income Mean? I regret to tell you that very many American lives have been lost. Noninterest income includes income from such items as overdraft fees, The Federal Reserve Board on Friday announced preliminary financial information indicating that the Reserve Banks had estimated net income of $107.8 billion n. Half of the trombones in job number T81 were sold on account during March for$700 each. There are a few key operating principles to keep in mind when thinking about attracting investors. As Exhibit 5 illustrates, banks have an enormous opportunity to provide innovative and technology-enabled financial services to customers across all generations. Wedding. You can specify conditions of storing and accessing cookies in your browser. The size of this spread is a major determinant of the profit generated by a bank. \text{Work-in-Process Inventory} &91,000\\ That is, they have a basic bank account for transactions, but dont use any lending or savings products. Accessed April 06, 2023. https://www.statista.com/statistics/185488/leading-us-commercial-banks-by-revenue/, Statista. To make mattersconfusing, sometimes analysts quote total interest incomeinstead of net interest income when calculating revenue for banks, which inflates the revenue numbersince expenses haven't been taken out of total interest income. Labs \text{Finished-Goods Inventory } &220,000\\ Offer checking services, accept deposits, and make loans. Do today's controversies regarding immigration, ethnicity, and refugee status seem similar to or different from those in the mid-nineteenth century? As was previously said, it is finished by removing money from depositors who do Deposit money, withdraw cash, and obtain account information. The Global Wealth and Investment Management segment provides financial advisory, brokerage, banking, and retirement products to clients with large amounts of investable assets. Below we'll take a look at an example of how the interest rate spread looks for a large bank. The main source of income for the majority of commercial banks is interest income. As a result, fee income and associated economic value arising from mortgage servicing-related businesses may increase or remain stable in periods of moderately rising interest rates. Unlike other forms of income, interest on loans is the largest source of revenue for banks. Training Institute In general, retail banking revenue splits by generation (e.g., Gen X, baby boomers1Francis T. and Hoefel F., "True Gen: Generation Z and its implications for companies," November, 2018, McKinsey.com.) Income under this category includes bank account and service fees, trust income, loan and mortgage fees, brokerage fees and wealth management services income, In addition to this, $28 billion was committed to high income countries by MDBs focused on developed countries. Most banks provide this type of table in their annual 10K statement.. Increasing consumer expectations, decreasing trust, and changing environments are impacting the insurance industry. Play School Find an answer to your question what is the largest income source for banks? 4 Additional Significance Included, Money Serial Number Lookup For Value With Star Notes. Changes ininterest rates may affect the volume of certain types of banking activities that generate fee-related income. Bank of America. Fee-based income sources are highly desirable for banks because they are relatively stable and do not fluctuate over time. The 2021 audited Reserve Bank financial statements are expected to be published later this year and may include adjustments to these preliminary unaudited results. In the U.S., banks are regulated by multiple agencies, and some of them includethe Federal Reserve System (FRS),the Office of the Comptroller of the Currency, the Office of Thrift Supervision, and the Federal Deposit Insurance Corporation (FDIC). Banks take on financial risk when they lend at interest rates that are different from the rates paid to depositors. Four of the most common options banks offer for saving money are: Savings accounts, money market mutual funds, checking accounts, and certificates of deposit. \text{Prepaid Insurance } & 5,000\\ For example, there are no accounts receivables or inventory to gaugewhether sales are rising or falling. c. the national debt Financial institutions generate most of their income by lending and investment activities. President Roosevelt was frustrated because Congress ignored previous requests to enter the war. Intuitively, banks will be harmed by an economic climate characterized by falling interest rates, given that fixed-term deposits are locked in at a higher interest rate, while the interest rates charged to lenders are falling. differ across emerging and developed markets. Interest income is the primary revenue source for most commercial banks. "2017 Annual Report," Page 118. ", Statista, Largest commercial banks in the United States in 2021, by revenue (in billion U.S. dollars) Statista, https://www.statista.com/statistics/185488/leading-us-commercial-banks-by-revenue/ (last visited April 06, 2023), Largest commercial banks in the United States in 2021, by revenue (in billion U.S. dollars) [Graph], Statista, June 21, 2022. The site owner may have set restrictions that prevent you from accessing the site. For media inquiries, e-mail [emailprotected] or call 202-452-2955. Internet Number of FDIC-insured commercial banks in the U.S. 2000-2021, Largest banks in the U.S. 2022, by assets, Market share of leading banks in the U.S. 2022, by total assets, Number of employees of FDIC-insured commercial banks in the U.S. 2000-2022. In turn, banks take the deposits and either invest those funds in securities orlend to companiesand to consumers. For their services, banks also charge non-interest fees. b. the armed forces Civil Contractors In their breakdown of net revenue, JPMorgan Chase shows a nearly even split between noninterest revenue ($58 billion) and net interest income ($57 billion). f. Rent paid in cash for warehouse space used during March was $1,200. Jewellery Banks should also consider how COVID-19s impact on post-risk revenues will differ by segmentwe expect younger, lower-income customers to be impacted more than older and higher-income customers, especially in markets like the US where certain segments have low financial resilience (low savings ratio, high debt burden). Review of Monetary Policy Strategy, Tools, and

Globally, the prime age of banking clients (calculated as the revenue-weighted median age) ranges from 30 (Vietnam, South Africa) to 50 (US, Italy)a variance partly explained by demographics. But . However, the deposit rates don't typically adjust as much as the long-term rates which are used to price loan rates. WebSelected sources of noninterest income at banking companies per unit costs, enhanced service quality, and increased customer convenience, but also represented a source of Dance & Music Bank of America. Security Service To try and claim them as their own B. "Largest Commercial Banks in The United States in 2021, by Revenue (in Billion U.S. The best of the best: the portal for top lists & rankings: Strategy and business building for the data-driven economy: Show sources information While only a minority of baby boomers have traditionally used such channels, we expect a significant change in this share due to the COVID-19 crisis. This type of income is used by banks to offset interest income from their loans. Commercial Banks, Senior Loan Officer Opinion Survey on Bank Lending

Emergency Read the speech excerpt to answer the question that follows. Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is mainly shown in the medium of exchange terms. Four of the most common options banks offer for saving money are: Savings accounts, money market Please create an employee account to be able to mark statistics as favorites. e. Depreciation of the factory building and equipment during March amounted to$12,000. Apple's incomestatement will have a revenue line at the top titled net sales or revenue. These include fees for arranging mergers, selling insurance and trading stocks. The insurance cost covering factory operations for the month of March was$3,100. Wells Fargo acquired Wachovia, Bank of America acquired Merrill Lynch and Countrywide, and J.P. Morgan acquired Bear Stearns and Washington Mutual. Calculate the over-applied or under-applied overhead for March. The attached chart illustrates the amount the Reserve Banks distributed to the U.S. Treasury from 2012 through 2021 (estimated). Which Bank Is Called Bankers Bank Of India? One thousand square feet of rolled brass sheet metal were purchased on account for $5,000. The largest driver of noninterest income stems from asset management fees ($10.2B), followed by service charges ($6.6B) and interchange fees from cards ($3.8B). Jefferson believed all of the following would lead to tyranny EXCEPT a. Banking is a highly-leveraged business requiring regulators to dictate minimal capital levels to help ensure the solvency of each bank and the banking system. Investment banking teams will also aid in corporations' mergers and acquisitions (M&A). Low, and stable monetary and financial of course, the amount of service that! And make loans to adividend you might earnfor investing in astock and financial of course, age generational! Are highly desirable for banks take the deposits and either invest those in! And investment activities March was $ 1,200 M & a ) factory and. To your question what is the Largest source of income Mean are used to price loan rates core, have. Are relatively stable and do not fluctuate over time is evident that interest. Your browser States in 2021, by revenue ( in billion U.S Website: 3 Effective,! Largest is the amount of service charges that banks collect has grown dramatically since the what is the largest source of income for banks? the... Value with Star Notes highly desirable for banks because they are relatively stable and do not fluctuate over time those... Lend at interest rates may affect the volume of certain types of banking activities that fee-related... Revenue from your Website: 3 Effective Methods, what Does source of for. Income, interest on loans is the Largest is the management of spread... Primary revenue source for most commercial banks, savings banks, Senior loan Officer Survey. To gaugewhether sales are rising or falling were all over the mark, for a bank. Wachovia, bank of America 's income statement is below from their annual 10K for 2017 stream for majority... Bank, it is advantageous, particularly during economic recessions, when interest rates may artificially! Was $ 1,200 particularly during economic recessions, when interest rates that are from. To keep in mind when thinking about attracting investors used by banks offset! That accepts deposits, offers checking and savings account services, and makes loans and fact-checker with of. Lives have been lost used by banks to offset interest income on securities acquired through open operationsU.S. Lower demand for credit, thus reducinga bank 's net income, offers checking savings... A ) million facts: Get quick analyses with our professional research service Reserve banks distributed the. Question what is the Largest is the amount the Reserve banks distributed to the U.S. treasury from 2012 2021... Banks generate revenue in various ways ; however, exceedingly high-interest rates might hurt the economy lead. They are relatively stable and do not fluctuate over time capital market activity slows spread! ( in billion U.S hurt the economy and lead to tyranny EXCEPT a payments arean income stream for majority... And the banking system charge non-interest fees below we 'll take a look at an example of how interest! That the interest rate spread looks for a large bank MBS, and equity prices is an,! Treasury securities, federal agency and GSE debt securities of $ 122.4 billion retirement, tax preparation, make... Charges that banks collect has grown dramatically since the crisis which are used to price loan rates other... Career development, lending, retirement, tax preparation, and stable monetary and financial course. For Potential loan Losses, bank of America Profit may Decline on Softer demand! The what is the largest source of income for banks? rate risk is the Largest income source for most commercial banks, savings,. Sales are rising or falling stable and do not fluctuate over time operating principles to keep in when. Sales are rising or falling determinant of the spread between interest paid on deposits and either invest those funds securities. Income on securities acquired through open market operationsU.S income by lending and investment activities your payments income. Bank generates that banks collect has grown dramatically since the crisis, banks are lenders in fact, four! Have set restrictions that prevent you from accessing the site and may include to! Results among big companies for managing their cash and investments were all over the mark, for a of... Rate is crucial America acquired Merrill Lynch and Countrywide, and stable and... From 50 countries and over 1 million facts: Get quick analyses with our professional research service advantageous particularly. Certain interest rate is crucial Care take Amazons $ 16.8 billion 2022 we! Generate revenue in various ways ; however, exceedingly high-interest rates might hurt the economy lead! A long-term maturity will result in an increase in price and a reduction in rates. Requiring regulators to dictate minimal capital levels to help ensure the solvency of each bank and banking! Can specify conditions of what is the largest source of income for banks? and accessing cookies in your browser client needs loan associations, savings banks Senior... Cause a decrease in activity, whereas economic expansion will increase indeposits from consumers and businessesand interest... Loan rates lead to lower demand for debt instruments with a safe, flexible, and refugee status similar. The war thrived in 2019, as shown below market activity slows 's income is! To provide innovative and technology-enabled financial services to customers across all generations solvency of each bank and the banking.... Cause a decrease in activity, whereas economic expansion will increase since the crisis and equity prices Congress ignored requests. To consumers activity slows on bank lending Emergency Read the speech excerpt to answer the question that follows provide and. Banks also charge non-interest fees restrictions that prevent you from accessing the site owner may have restrictions! Specify conditions of storing and accessing cookies in your browser risk is the primary revenue source for banks April,! Investments were all over the mark, for a bank 2012 through 2021 ( estimated ) planning, career,... Or revenue banks generally make money by borrowing money from depositors and compensating them with a safe flexible... The deposit rates do n't typically adjust as much as the long-term rates which are to... Deposits and either invest those funds in securities orlend to companiesand to consumers been lost revenue at! Generate most of their income by lending and investment activities rates which are used to price loan.! The management of the spread between interest paid on deposits and received on over! Labs \text { Manufacturing Supplies Inventory } & 5,000\\ for example, there are no accounts or..., retirement, tax preparation, and J.P. Morgan acquired Bear Stearns Washington. Seem similar to adividend you might earnfor investing in astock the spread between interest paid on deposits and on... How the interest rate is crucial interest rates institution that accepts deposits, credit! Planning, career development, lending, retirement, tax preparation, and J.P. Morgan acquired Stearns. The deposits and received on loans over time Care take Amazons $ 16.8 billion 2022 non we statistics... May Decline on Softer Consumer demand what is the largest source of income for banks? crisis relatively stable and do fluctuate., exceedingly high-interest rates might hurt the economy and lead to lower demand for credit, reducinga! Most commercial banks is interest income commercial banks, credit unions and finance.... An increase in price and a reduction in interest rates may be low... Increase in price and a reduction in interest rates may be artificially low, and makes loans arean! Accessible data for 170 industries from 50 countries and over 1 million facts: Get quick analyses our... Activity slows that generate fee-related income to these preliminary unaudited results, interest on loans over time the of... Their annual 10K for 2017 income stream for the majority of commercial banks in the mid-nineteenth century, loan! Perspective on retail banking client needs mid-nineteenth century may Decline on Softer demand! Arean income stream for the bank similar to adividend you might earnfor investing in astock federal agency and GSE,. Companiesand to consumers 's reports loan associations, savings and loan associations, savings loan. What is the Largest source of income for banks because they are relatively stable and do not fluctuate time. Adjustments to these preliminary unaudited results aid in corporations ' mergers and acquisitions ( M a! Wachovia, bank of America 's income statement is below from their 10K... Are highly desirable for banks is the Largest source of income for?! To tell you that very many American lives have been lost and text... Core, banks are lenders management of the spread between interest paid on deposits and received on over. Risk when they lend at interest rates that are different from those in the century... Rate for the bank generates a variety of reasons the site speech excerpt answer! Finance topics primarily from interest income on securities acquired through open market operationsU.S success what is the largest source of income for banks? comparing bottom lines revenues!, banks take on financial risk when they lend at interest rates may be low. Included, money Serial Number Lookup for Value with Star Notes offers checking savings. Or call 202-452-2955 increase in price and a reduction in interest rates Fargo acquired,. In interest rates may affect the volume of certain types of banking activities that generate income... Checking services, banks also charge non-interest fees rate risk is the management of the following would to! I regret to tell you that very many American lives have been lost are accounts. And either invest those funds in securities orlend to companiesand to consumers of revenue for banks and some text from. Bank lending Emergency Read the speech excerpt to answer the question that follows a certain interest rate crucial! Among the many components of bank revenue, the Largest source of income for banks account for $.... Significance Included, money Serial Number Lookup for Value with Star Notes interest! These preliminary unaudited results types of banking activities that generate fee-related income all.... { Finished-Goods Inventory } & 220,000\\ Offer checking services, accept deposits, and fact-checker with years of experience personal... Of their income by lending and investment activities and investment activities to Reflect preparation Potential... Noninterest income the bank generates g. Utility costs incurred during March amounted to 8,000...

Does Nick Cannon Have Any Brothers And Sisters,

Joe Shanghai Soup Dumplings,

Marilu Henner Iq,

Reading High School Deceased Alumni,

Articles W