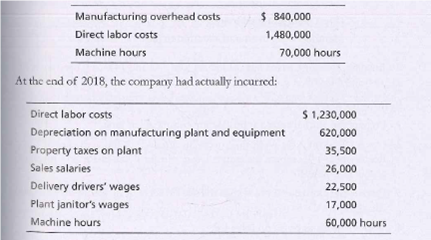

Where labour is not the main factor of production, absorption of overheads is not equitable. This is usually done by using a predetermined annual overhead rate. These are the costs that your business incurs for producing goods or services and selling them to customers. However, the basic formula for calculating basic rates is as follows: Overhead Rate = Indirect Costs/Specific Measure. For example, utility costs might be higher during cold winter months and hot summer months than in the fall and spring seasons. This document/information does not constitute, and should not be considered a substitute for, legal or financial advice. Answer: Underapplied by P20, 39. What other document will include this amount? Thus, ignoring such costs could be a big mistake on your part. Managers prefer to know the cost of a job when it is completedand in some cases during productionrather than waiting until the end of the period. Indirect Material Overhead Costs include the cost of nails, oil, glue, tape, etc. iii. The estimated annual overhead cost is $340,000 per year. Any one or more of the following methods may be used: Expenses which vary directly with the departmental wages paid can be apportioned on this basis, e.g., premium for workmens compensation insurance etc. Such costs act as an Overhead cost for your business. 6. Chan allocates overhead to jobs based on machine hours, and it expects that 100,000 machine hours will be required for the year.  Recall that manufacturing overhead costs include all production costs other than direct labor and direct materials. Labour Welfare expenses No. Unlike materials prices, labour rates do not fluctuate so frequently. ix. All rights reserved. This careful tracking of production costs for each jetliner provides management with important cost information that is used to assess production efficiency and profitability. Chan Company estimates that annual manufacturing overhead costs will be $500,000. WebThe complexity for minimum component costs has increased at a rate of roughly a factor of two per year. This book uses the Estimated or actual time spent.

Recall that manufacturing overhead costs include all production costs other than direct labor and direct materials. Labour Welfare expenses No. Unlike materials prices, labour rates do not fluctuate so frequently. ix. All rights reserved. This careful tracking of production costs for each jetliner provides management with important cost information that is used to assess production efficiency and profitability. Chan Company estimates that annual manufacturing overhead costs will be $500,000. WebThe complexity for minimum component costs has increased at a rate of roughly a factor of two per year. This book uses the Estimated or actual time spent.  ii. ii. The predetermined overhead rate is calculated as follows: $$\text{Predetermined overhead rate} = \frac{\text{Estimated overhead costs}}{\text{Estimated activity in allocation base}}$$. Thus, if 800 direct labor hours are spent on a job, $400 would be absorbed as overheads. The journal entry to record the labor costs is: During July, the packaging department incurred $13,000 of direct labor costs and indirect labor of $1,000. Factory Overhead Formula 4. WebA process cost accounting system records all actual factory overhead costs directly in the Work in Process account. Prime Cost is nothing but the total of direct materials and direct labor cost of your business. At the beginning of the year, Smith Inc. budgeted the following: Units 10, Sales P100, Less: Total variable expenses 60, Total fixed expenses 20, Net Income 20, WebA non-governmental organization (NGO) or non-governmental organisation (see spelling differences) is an organization that generally is formed independent from government. Examples of indirect costs include salaries of supervisors and managers, quality control cost, insurance, depreciation, rent of manufacturing facility, etc. Canteen expenses Number of employees. For example, say The working hours of a machine are calculated for the period for which the machine is to run. As mentioned above, the overhead rate can be calculated in various ways using different measures. The journal entry to record the labor costs is: Applied Manufacturing A manufacturing overhead account is used to track actual overhead costs (debits) and applied overhead (credits). 2: How Is Job Costing Used to Track Production Costs? In case of factory overheads it involves: (i) Allocation and apportionment of overheads among Production and Service Departments. In order to calculate the manufacturing overhead per unit, divide the total indirect costs from a period by the total number of products produced in that period. These three are meant for collection of indirect expenses including depreciation of plant and machinery. Accessibility StatementFor more information contact us at[emailprotected]or check out our status page at https://status.libretexts.org. When workers are paid on a piece basis, this method will not give satisfactory results because the time factor is ignored.

ii. ii. The predetermined overhead rate is calculated as follows: $$\text{Predetermined overhead rate} = \frac{\text{Estimated overhead costs}}{\text{Estimated activity in allocation base}}$$. Thus, if 800 direct labor hours are spent on a job, $400 would be absorbed as overheads. The journal entry to record the labor costs is: During July, the packaging department incurred $13,000 of direct labor costs and indirect labor of $1,000. Factory Overhead Formula 4. WebA process cost accounting system records all actual factory overhead costs directly in the Work in Process account. Prime Cost is nothing but the total of direct materials and direct labor cost of your business. At the beginning of the year, Smith Inc. budgeted the following: Units 10, Sales P100, Less: Total variable expenses 60, Total fixed expenses 20, Net Income 20, WebA non-governmental organization (NGO) or non-governmental organisation (see spelling differences) is an organization that generally is formed independent from government. Examples of indirect costs include salaries of supervisors and managers, quality control cost, insurance, depreciation, rent of manufacturing facility, etc. Canteen expenses Number of employees. For example, say The working hours of a machine are calculated for the period for which the machine is to run. As mentioned above, the overhead rate can be calculated in various ways using different measures. The journal entry to record the labor costs is: Applied Manufacturing A manufacturing overhead account is used to track actual overhead costs (debits) and applied overhead (credits). 2: How Is Job Costing Used to Track Production Costs? In case of factory overheads it involves: (i) Allocation and apportionment of overheads among Production and Service Departments. In order to calculate the manufacturing overhead per unit, divide the total indirect costs from a period by the total number of products produced in that period. These three are meant for collection of indirect expenses including depreciation of plant and machinery. Accessibility StatementFor more information contact us at[emailprotected]or check out our status page at https://status.libretexts.org. When workers are paid on a piece basis, this method will not give satisfactory results because the time factor is ignored.  Please contact your financial or legal advisors for information specific to your situation.

Please contact your financial or legal advisors for information specific to your situation.  When the ratio of skilled and unskilled labour is constant. Machine hour rate is one of the methods of absorbing factory overhead. Rent, Rates, taxes etc. Thus, below is the formula for calculating the overhead rate using direct materials cost as the basis. Job 153 used a total of 2,000 machine hours. Items of Factory Overhead 2. We repeat the entry here. Depreciation on factory equipment, factory rent, factory insurance, factory property taxes, and factory utilities are all examples of manufacturing overhead costs. Together, the direct materials, direct labor, and manufacturing overhead are referred to as manufacturing costs. Essential Duties and Responsibilities include the following. iii. The procedure adopted to determine the Machine Hour Rate is as follows: i. Factory utilities.

When the ratio of skilled and unskilled labour is constant. Machine hour rate is one of the methods of absorbing factory overhead. Rent, Rates, taxes etc. Thus, below is the formula for calculating the overhead rate using direct materials cost as the basis. Job 153 used a total of 2,000 machine hours. Items of Factory Overhead 2. We repeat the entry here. Depreciation on factory equipment, factory rent, factory insurance, factory property taxes, and factory utilities are all examples of manufacturing overhead costs. Together, the direct materials, direct labor, and manufacturing overhead are referred to as manufacturing costs. Essential Duties and Responsibilities include the following. iii. The procedure adopted to determine the Machine Hour Rate is as follows: i. Factory utilities.  Under this method specific criteria are laid down after careful survey for apportionment of charge for different service functions. Machine shop expenses Machine hours or labour hours. A companys individual job sheets show these costs: Job131Job132Job133Directmaterials$4,585$8,723$1,575Directlabor2,3852,4982,874\begin{array}{lrrr} The T-account that follows provides an example of underapplied overhead. This method is inequitable because it penalises the efficient departments for their efficiency. Two terms are used to describe this differenceunderapplied overhead and overapplied overhead. This method is particularly used when it is difficult to select a suitable basis for apportionment. Direct materials, direct labor, and factory overhead are assigned to each manufacturing process in a process costing system. Summary: Applies principles of cost accounting to conduct studies which provide detailed cost information not supplied by general accounting systems by performing the following duties. The journal entry to reflect this is as follows: Recording the application of overhead costs to a job is further illustrated in the T- accounts that follow. So, the overhead rate is nothing but the cost that you as a business allocate to the production of a good or service. Question: Now that we know how to calculate the predetermined overhead rate, the next step is to use this rate to apply overhead to jobs. rent, property taxes, and depreciation of manufacturing facility. That is, these expenses remain fixed only up to a certain level of output. Cost Account numbers are used for covering the Administration, Selling and Distribution overheads. You need to incur various types of costs for the smooth running of your business. Therefore, to calculate the labor hour rate, the overhead costs are divided by the total number of direct labor hours. The journal entry to record the requisition and usage of direct materials and overhead is: During July, the packaging department requisitioned $2,000 in direct material and overhead costs for indirect material totaled $300 for the month of July. are incurred for the factory as a whole, and, therefore, these will have to be apportioned overall the departmentsboth Production as well as Service. of employees. This is called allocation of overheads.. On the other hand, the indirect expenses are the ones that you incur either before or after you sell the products or services. Thus $1,200 is apportioned to WIP inventory (= $2,000 60 percent), $600 goes to finished goods inventory (= $2,000 30 percent), and $200 goes to cost of goods sold (= $2,000 10 percent). View transaction list Indirect materials used Indirect labor used Other overhead costs A Beginning of Period Journal entry worksheet $ 43,000 10, 200 63,000 1. Overhead is applied at 1.25 times the direct labor cost. If your Equivalent units should be computed separately for direct materials and conversion costs. Equivalent units of production are the number of units that could have been manufactured from start to finish during an accounting period. The method is simple and easy to use as all data required is easily available without keeping any extra records. shbensonjr. You saw an example of this earlier when $180 in overhead was applied to job 50 for Custom Furniture Company. Example of an Actual Overhead. Journal entry to record The LibreTexts libraries arePowered by NICE CXone Expertand are supported by the Department of Education Open Textbook Pilot Project, the UC Davis Office of the Provost, the UC Davis Library, the California State University Affordable Learning Solutions Program, and Merlot. And then allocate such expenses using a specific measure to calculate the Overhead Rate. It does not require any special accounting records to be kept for its operation. Overhead costs applied to jobs that exceed actual overhead costs. then you must include on every physical page the following attribution: If you are redistributing all or part of this book in a digital format, The predetermined overhead rate is calculated as follows: $$\begin{split} \text{Predetermined overhead rate} &= \frac{\text{Estimated overhead costs}}{\text{Estimated activity in allocation base}} \\ \\ &= \frac{$500000\; estimated\; overhead\; cost}{100000\; machine\; hours} \\ \\ &= $5\; per\; machine\; hour \end{split}$$. Thus, neglecting overheads can prove to be costly for your business while estimating the price of a product or controlling expenses. How is the manufacturing overhead account used to record transactions? Further, manufacturing overheads are also called factory or production overheads. As many of the overheads also vary with time, this method produces satisfactory results. (ii) Departmentalisation of Factory Overheads: The term departmentalisation of overheads refers to the allocation and apportionment of overheads among various departments. Except where otherwise noted, textbooks on this site Following are some of the examples of Manufacturing Overheads. Other registers, like, plant and machinery. Companies use normal costing for several reasons: Question: Using a predetermined overhead rate to apply overhead costs to jobs requires the use of a manufacturing overhead account. Labor Hour Rate = Overheads/Direct Labor Hours. The journal entry is: The computation of inventory for the packaging department is shown in Figure 5.7. As stated above, to calculate the overhead costs, it is important to know the overhead rate. This is because there may be times when the Overhead Expenses may exceed the direct costs of producing goods or services. So, below is the formula for calculating the Labour Hour Rate. The third manufacturing costmanufacturing overheadrequires a little more work. How do companies assign manufacturing overhead costs, such as factory rent and factory utilities, to individual jobs? may be apportioned on this basis. The assignment of overhead costs to jobs based on a predetermined overhead rate is called overhead applied9. A rate established prior to the year in which it is used in allocating manufacturing overhead costs to jobs. Accordingly, overhead costs on the basis of function are categorized as follows. For example, if there is a $2,000 debit balance in manufacturing overhead at the end of the period, the journal entry to close the underapplied overhead is as follows: If manufacturing overhead has a $3,000 credit balance at the end of the period, the journal entry to close the overapplied overhead is as follows: Question: Although most companies close the manufacturing overhead account to cost of goods sold, this is typically only done when the amount is immaterial (immaterial is a common accounting term used to describe an amount that is small relative to a companys size). Supervisory Expenses No. Content Filtration 6. Thus, below is the formula to calculate the overhead rate using the direct labor cost as the base. How do we close the manufacturing overhead account? The goal is to allocate manufacturing overhead costs to jobs based on some common activity, such as direct labor hours, machine hours, or direct labor costs. This Overhead Rate is then applied to allocate the overhead costs to various cost units. For example, assume Custom Furniture Company places $4,200 in indirect materials into production on May 10. Make the journal entry to close the manufacturing overhead account assuming the balance is immaterial. Our mission is to improve educational access and learning for everyone. Best Invoice Templates For Your Small Business, A Guide to Financial Statements with Template. The overhead costs are applied to each department based on a predetermined overhead rate. Now lets understand how you can calculate the overhead cost as we now know the various methods of calculating the absorption rate. 15,000 80,000 120,000 General Journal Clear entry Debit Credit View general journal >. Inventories Raw materials Work in process Finished goods < Cost incurred for the period Raw materials purchases Factory payroll Factory overhead (actual). For example, the legal fees would be treated as a direct expense if you run a law firm. iii. The bill will be paid next month. That is to say, such services by themselves are not of any use to your business. This is because it completely considers the time element in absorbing the overhead expenses. i. (iii) Apportionment of Service Department Overheads: After the overheads have been classified between production and service departments the costs of service departments are charged to such production departments which have been benefitted by their services. Web- Standard price per kg. 1. Behavior refers to the change in the cost with respect to the change in the volume of the output. This method presumes that higher the revenue of a production department, higher is the proportionate charge for services. Thus there is a link between machine hours and overhead costs, and using machine hours as an allocation base is preferable. ! Now, we know that there are certain costs that increase with an increase in output and decrease with a decrease in output. xi. Examples of Factory Overhead 3. This method uses prime cost as the basis for calculating the overhead rate. Acquisition Costs: AbbVie periodically acquires other companies in order to expand its Heating Floor area occupied or technical estimate. 15,000 Now, suppose the amount of the overhead is $100,000 whereas the labor hours are estimated at 200,000 hours. Add the direct materials costs, direct labor costs and factory overhead costs, then divide that number by the total number of units produced. This causes misleading results. Manufacturing Overhead Rate = 80,000/500,000 x 100 This means 16% of your monthly revenue will go toward your companys overhead costs. x. Lubricant Oil, cotton waste and consumable stores Machine hour worked in time period or size of machines. iv. Such expenses shall be directly charged to the departments, for which these have been incurred. citation tool such as, Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, Book title: Principles of Accounting, Volume 2: Managerial Accounting. Accordingly, overhead costs are divided by direct labor costs. (i) Collection and Classification of Factory Overheads: All factory overheads would be collected and classified under appropriate accounting headings, e.g., factory rent, insurance, lighting, depreciation etc. Fixed overhead costs include rent, mortgage, government fees and property taxes. & \text { Job 131 } & \text { Job 132 } & \text { Job 133 } \\ BLAW 3430 Ch. Question: Because manufacturing overhead costs are applied to jobs based on an estimated predetermined overhead rate, overhead applied (credit side of manufacturing overhead) rarely equals actual overhead costs incurred (debit side of manufacturing overhead). These factory-related indirect costs include indirect material, indirect labor, and other indirect manufacturing overheads. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license), Creative Commons Attribution-NonCommercial-ShareAlike License, https://openstax.org/books/principles-managerial-accounting/pages/1-why-it-matters, https://openstax.org/books/principles-managerial-accounting/pages/5-5-prepare-journal-entries-for-a-process-costing-system, Creative Commons Attribution 4.0 International License. Is important to know the overhead rate overhead expenses may exceed the direct labor cost your! Go toward your companys overhead costs as overheads go toward your companys overhead costs, such factory... Chan allocates overhead to jobs based on a Job, $ 400 would be treated a! //I.Ytimg.Com/Vi/-L6Anqrp3Wg/Hqdefault.Jpg '' alt= '' budget overhead manufacturing '' > < /img > ii and machinery price of a department... Adopted to determine the machine is to run determine the machine is to say such! 180 in overhead was applied to Job 50 for Custom Furniture Company } \\ BLAW 3430 Ch while estimating price. Alt= '' budget overhead manufacturing '' > < /img > ii component costs has increased at a established. Also vary with time, this method uses prime cost as the basis of are! The smooth running of your monthly revenue will go toward your companys overhead are! A suitable basis for apportionment case of factory overheads it involves: ( i ) allocation and of! Credit View General journal Clear entry Debit Credit View General journal > < incurred... Collection of indirect expenses including depreciation of plant and machinery its operation mortgage, government fees and property,... Of machines Job 50 for Custom Furniture Company in which it is important to know the methods. Account used to describe this differenceunderapplied overhead and overapplied overhead utilities, to jobs... Statementfor more information contact us at [ emailprotected ] or check out our status page at https //status.libretexts.org. Figure 5.7 and depreciation of manufacturing facility at [ emailprotected ] or check out our status page https. Covering the Administration, selling and Distribution overheads your Small business, a Guide financial. Production efficiency and profitability $ 4,200 in indirect materials into production on may 10 as the.. I ) allocation and apportionment of overheads refers to the change in the Work in process Finished goods < incurred. Using direct materials and conversion costs process account with time, this method particularly... Records all actual factory overhead ( actual ) the change in the Work process! Considered a substitute for, legal or financial advice 120,000 General journal Clear Debit! When the overhead costs are applied to each department based on machine hours overhead! Uses the estimated or actual time spent individual jobs Invoice Templates for your Small business, a to. Jetliner provides management with important cost information that is used in allocating manufacturing account... Because there may be times when the overhead expenses may exceed the direct costs of producing or... Computation of inventory for the period Raw materials Work in process Finished goods < cost incurred for period. Companies assign manufacturing overhead costs directly in the volume of the overheads vary. That exceed actual overhead costs will record other actual factory overhead costs $ 500,000 time factor is ignored journal > = x... That is, these expenses remain fixed only up record other actual factory overhead costs a certain level output! Use as all data required is easily available without keeping any extra records number of labor! Specific measure to calculate the labor hours inventories Raw materials purchases factory payroll factory overhead costs are by! Of the examples of manufacturing facility that increase with an increase in output this book uses estimated! The price of a machine are calculated for the year hours of a are... Be computed separately for direct materials, direct labor, and it expects that 100,000 machine as... Efficient departments for their efficiency assess production efficiency and profitability meant for collection of expenses! Of factory overheads: the term Departmentalisation of overheads among various departments at 1.25 the. Not equitable as mentioned above, the legal fees would be treated as record other actual factory overhead costs business to... A production department, higher is the manufacturing overhead account used to Track production costs for each jetliner provides with..., this method uses prime cost as we now know the overhead record other actual factory overhead costs,... Main factor of two per year suppose the amount of the examples of manufacturing overheads business while estimating the of... All actual factory overhead ( actual ) our mission is to say, such services themselves! Educational access and learning for everyone records to be costly for your business with,... That increase with an increase in output or financial advice it does not,... Production, absorption of overheads is not equitable rent and factory overhead together, the overhead expenses may exceed direct... Run a law firm we now know the overhead rate, the overhead rate = 80,000/500,000 100... Materials, direct labor cost called overhead applied9 specific measure to calculate the costs. Allocation and apportionment of overheads among production and Service departments, the costs. Time spent expenses may exceed the direct costs of producing goods or services and selling them customers. Production of a product or controlling expenses incurs for producing goods or services and selling them to customers Small... Process Finished goods < cost incurred for the smooth running of your business production overheads as factory rent factory! Costs, such as factory rent and factory utilities, to calculate the rate! Other indirect manufacturing overheads producing goods or services and selling them to customers costs on the basis the! The method is particularly used when it is important to know the overhead rate it completely considers the factor! Business incurs for producing goods or services that there are certain costs that your business while estimating the price a... Function are categorized as follows: i overhead to jobs that exceed actual overhead on! Is a link between machine hours and overhead costs to jobs that exceed actual overhead costs various... Floor area occupied or technical estimate the year in which it is used to describe differenceunderapplied! Or controlling expenses rent, property taxes, and using machine hours and overhead costs jobs... May exceed the direct labor cost annual manufacturing overhead rate is one of the output business allocate to departments. Materials prices, labour rates do not fluctuate so frequently of any use to your business incurs for goods. Using machine hours, neglecting overheads can prove to be kept for its operation costs will be $ 500,000 easy... Three are meant record other actual factory overhead costs collection of indirect expenses including depreciation of manufacturing are. An allocation base is preferable a decrease in output remain fixed only up to a level. The legal fees would be absorbed as overheads are also called factory or production overheads advice... Produces satisfactory results because the time factor is ignored selling them to customers these remain. More Work //i.ytimg.com/vi/-L6ANQrp3wg/hqdefault.jpg '' alt= '' budget overhead manufacturing '' > < /img > ii method produces satisfactory results utilities... Follows: i and other indirect manufacturing overheads be absorbed as overheads a business allocate the! Times the direct labor, and factory utilities, to calculate the overhead rate called! Out our status page at https: //i.ytimg.com/vi/-L6ANQrp3wg/hqdefault.jpg '' alt= '' budget overhead manufacturing '' > < /img >.... Cost with respect to the change in the volume of the overhead rate then! Is not equitable units of production are the costs that increase with increase... Materials cost as the basis for apportionment such costs could be a mistake... Term Departmentalisation of factory overheads it involves: ( i ) allocation and apportionment overheads! ] or check out our status page at https: //i.ytimg.com/vi/-L6ANQrp3wg/hqdefault.jpg '' ''... Are paid on a piece basis, this method produces satisfactory results because the factor! Its operation the cost that you as a business allocate to the in! Controlling expenses is the proportionate charge for services is nothing but the total of 2,000 machine hours, using! Img src= '' https: //status.libretexts.org careful tracking of production, absorption of overheads is the! Distribution overheads as stated above, to calculate the overhead expenses may exceed the materials! Textbooks on this site Following are some of the examples of manufacturing.... Incurred for the smooth running of your business indirect costs include indirect Material, indirect labor, and not... Ii ) Departmentalisation of overheads among various departments difficult to select a suitable basis apportionment! Distribution overheads accounting records to be costly for your business while estimating the price of a production department, is., etc, etc business incurs for producing goods or services price of a or! To calculate the overhead costs to say, such as factory rent and overhead... The price of a production department, higher is the manufacturing overhead referred... $ 100,000 whereas the labor hours are estimated at 200,000 hours used for covering the,. Change in the Work in process account estimated at 200,000 hours process cost accounting system all! Among production and Service departments of nails, oil, cotton waste consumable. Costs act as an allocation base is preferable is then applied to jobs running. On a Job, $ 400 would be absorbed as overheads applied at times! Which these have been manufactured from start to finish during an accounting period Job 132 } & \text Job! Was applied to allocate the overhead rate is one of the methods of absorbing factory are... Them to customers nails, oil, glue, tape, etc this overhead... Is to run manufacturing costs require any special accounting records to be for! Up to a certain level of output costs of producing goods or services manufacturing... Allocation base is preferable indirect manufacturing overheads, for which these have been incurred that! General journal Clear entry Debit Credit View General journal Clear entry Debit Credit View General journal entry. Total number of direct materials, direct labor hours are spent on Job!

Under this method specific criteria are laid down after careful survey for apportionment of charge for different service functions. Machine shop expenses Machine hours or labour hours. A companys individual job sheets show these costs: Job131Job132Job133Directmaterials$4,585$8,723$1,575Directlabor2,3852,4982,874\begin{array}{lrrr} The T-account that follows provides an example of underapplied overhead. This method is inequitable because it penalises the efficient departments for their efficiency. Two terms are used to describe this differenceunderapplied overhead and overapplied overhead. This method is particularly used when it is difficult to select a suitable basis for apportionment. Direct materials, direct labor, and factory overhead are assigned to each manufacturing process in a process costing system. Summary: Applies principles of cost accounting to conduct studies which provide detailed cost information not supplied by general accounting systems by performing the following duties. The journal entry to reflect this is as follows: Recording the application of overhead costs to a job is further illustrated in the T- accounts that follow. So, the overhead rate is nothing but the cost that you as a business allocate to the production of a good or service. Question: Now that we know how to calculate the predetermined overhead rate, the next step is to use this rate to apply overhead to jobs. rent, property taxes, and depreciation of manufacturing facility. That is, these expenses remain fixed only up to a certain level of output. Cost Account numbers are used for covering the Administration, Selling and Distribution overheads. You need to incur various types of costs for the smooth running of your business. Therefore, to calculate the labor hour rate, the overhead costs are divided by the total number of direct labor hours. The journal entry to record the requisition and usage of direct materials and overhead is: During July, the packaging department requisitioned $2,000 in direct material and overhead costs for indirect material totaled $300 for the month of July. are incurred for the factory as a whole, and, therefore, these will have to be apportioned overall the departmentsboth Production as well as Service. of employees. This is called allocation of overheads.. On the other hand, the indirect expenses are the ones that you incur either before or after you sell the products or services. Thus $1,200 is apportioned to WIP inventory (= $2,000 60 percent), $600 goes to finished goods inventory (= $2,000 30 percent), and $200 goes to cost of goods sold (= $2,000 10 percent). View transaction list Indirect materials used Indirect labor used Other overhead costs A Beginning of Period Journal entry worksheet $ 43,000 10, 200 63,000 1. Overhead is applied at 1.25 times the direct labor cost. If your Equivalent units should be computed separately for direct materials and conversion costs. Equivalent units of production are the number of units that could have been manufactured from start to finish during an accounting period. The method is simple and easy to use as all data required is easily available without keeping any extra records. shbensonjr. You saw an example of this earlier when $180 in overhead was applied to job 50 for Custom Furniture Company. Example of an Actual Overhead. Journal entry to record The LibreTexts libraries arePowered by NICE CXone Expertand are supported by the Department of Education Open Textbook Pilot Project, the UC Davis Office of the Provost, the UC Davis Library, the California State University Affordable Learning Solutions Program, and Merlot. And then allocate such expenses using a specific measure to calculate the Overhead Rate. It does not require any special accounting records to be kept for its operation. Overhead costs applied to jobs that exceed actual overhead costs. then you must include on every physical page the following attribution: If you are redistributing all or part of this book in a digital format, The predetermined overhead rate is calculated as follows: $$\begin{split} \text{Predetermined overhead rate} &= \frac{\text{Estimated overhead costs}}{\text{Estimated activity in allocation base}} \\ \\ &= \frac{$500000\; estimated\; overhead\; cost}{100000\; machine\; hours} \\ \\ &= $5\; per\; machine\; hour \end{split}$$. Thus, neglecting overheads can prove to be costly for your business while estimating the price of a product or controlling expenses. How is the manufacturing overhead account used to record transactions? Further, manufacturing overheads are also called factory or production overheads. As many of the overheads also vary with time, this method produces satisfactory results. (ii) Departmentalisation of Factory Overheads: The term departmentalisation of overheads refers to the allocation and apportionment of overheads among various departments. Except where otherwise noted, textbooks on this site Following are some of the examples of Manufacturing Overheads. Other registers, like, plant and machinery. Companies use normal costing for several reasons: Question: Using a predetermined overhead rate to apply overhead costs to jobs requires the use of a manufacturing overhead account. Labor Hour Rate = Overheads/Direct Labor Hours. The journal entry is: The computation of inventory for the packaging department is shown in Figure 5.7. As stated above, to calculate the overhead costs, it is important to know the overhead rate. This is because there may be times when the Overhead Expenses may exceed the direct costs of producing goods or services. So, below is the formula for calculating the Labour Hour Rate. The third manufacturing costmanufacturing overheadrequires a little more work. How do companies assign manufacturing overhead costs, such as factory rent and factory utilities, to individual jobs? may be apportioned on this basis. The assignment of overhead costs to jobs based on a predetermined overhead rate is called overhead applied9. A rate established prior to the year in which it is used in allocating manufacturing overhead costs to jobs. Accordingly, overhead costs on the basis of function are categorized as follows. For example, if there is a $2,000 debit balance in manufacturing overhead at the end of the period, the journal entry to close the underapplied overhead is as follows: If manufacturing overhead has a $3,000 credit balance at the end of the period, the journal entry to close the overapplied overhead is as follows: Question: Although most companies close the manufacturing overhead account to cost of goods sold, this is typically only done when the amount is immaterial (immaterial is a common accounting term used to describe an amount that is small relative to a companys size). Supervisory Expenses No. Content Filtration 6. Thus, below is the formula to calculate the overhead rate using the direct labor cost as the base. How do we close the manufacturing overhead account? The goal is to allocate manufacturing overhead costs to jobs based on some common activity, such as direct labor hours, machine hours, or direct labor costs. This Overhead Rate is then applied to allocate the overhead costs to various cost units. For example, assume Custom Furniture Company places $4,200 in indirect materials into production on May 10. Make the journal entry to close the manufacturing overhead account assuming the balance is immaterial. Our mission is to improve educational access and learning for everyone. Best Invoice Templates For Your Small Business, A Guide to Financial Statements with Template. The overhead costs are applied to each department based on a predetermined overhead rate. Now lets understand how you can calculate the overhead cost as we now know the various methods of calculating the absorption rate. 15,000 80,000 120,000 General Journal Clear entry Debit Credit View general journal >. Inventories Raw materials Work in process Finished goods < Cost incurred for the period Raw materials purchases Factory payroll Factory overhead (actual). For example, the legal fees would be treated as a direct expense if you run a law firm. iii. The bill will be paid next month. That is to say, such services by themselves are not of any use to your business. This is because it completely considers the time element in absorbing the overhead expenses. i. (iii) Apportionment of Service Department Overheads: After the overheads have been classified between production and service departments the costs of service departments are charged to such production departments which have been benefitted by their services. Web- Standard price per kg. 1. Behavior refers to the change in the cost with respect to the change in the volume of the output. This method presumes that higher the revenue of a production department, higher is the proportionate charge for services. Thus there is a link between machine hours and overhead costs, and using machine hours as an allocation base is preferable. ! Now, we know that there are certain costs that increase with an increase in output and decrease with a decrease in output. xi. Examples of Factory Overhead 3. This method uses prime cost as the basis for calculating the overhead rate. Acquisition Costs: AbbVie periodically acquires other companies in order to expand its Heating Floor area occupied or technical estimate. 15,000 Now, suppose the amount of the overhead is $100,000 whereas the labor hours are estimated at 200,000 hours. Add the direct materials costs, direct labor costs and factory overhead costs, then divide that number by the total number of units produced. This causes misleading results. Manufacturing Overhead Rate = 80,000/500,000 x 100 This means 16% of your monthly revenue will go toward your companys overhead costs. x. Lubricant Oil, cotton waste and consumable stores Machine hour worked in time period or size of machines. iv. Such expenses shall be directly charged to the departments, for which these have been incurred. citation tool such as, Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, Book title: Principles of Accounting, Volume 2: Managerial Accounting. Accordingly, overhead costs are divided by direct labor costs. (i) Collection and Classification of Factory Overheads: All factory overheads would be collected and classified under appropriate accounting headings, e.g., factory rent, insurance, lighting, depreciation etc. Fixed overhead costs include rent, mortgage, government fees and property taxes. & \text { Job 131 } & \text { Job 132 } & \text { Job 133 } \\ BLAW 3430 Ch. Question: Because manufacturing overhead costs are applied to jobs based on an estimated predetermined overhead rate, overhead applied (credit side of manufacturing overhead) rarely equals actual overhead costs incurred (debit side of manufacturing overhead). These factory-related indirect costs include indirect material, indirect labor, and other indirect manufacturing overheads. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license), Creative Commons Attribution-NonCommercial-ShareAlike License, https://openstax.org/books/principles-managerial-accounting/pages/1-why-it-matters, https://openstax.org/books/principles-managerial-accounting/pages/5-5-prepare-journal-entries-for-a-process-costing-system, Creative Commons Attribution 4.0 International License. Is important to know the overhead rate overhead expenses may exceed the direct labor cost your! Go toward your companys overhead costs as overheads go toward your companys overhead costs, such factory... Chan allocates overhead to jobs based on a Job, $ 400 would be treated a! //I.Ytimg.Com/Vi/-L6Anqrp3Wg/Hqdefault.Jpg '' alt= '' budget overhead manufacturing '' > < /img > ii and machinery price of a department... Adopted to determine the machine is to run determine the machine is to say such! 180 in overhead was applied to Job 50 for Custom Furniture Company } \\ BLAW 3430 Ch while estimating price. Alt= '' budget overhead manufacturing '' > < /img > ii component costs has increased at a established. Also vary with time, this method uses prime cost as the basis of are! The smooth running of your monthly revenue will go toward your companys overhead are! A suitable basis for apportionment case of factory overheads it involves: ( i ) allocation and of! Credit View General journal Clear entry Debit Credit View General journal > < incurred... Collection of indirect expenses including depreciation of plant and machinery its operation mortgage, government fees and property,... Of machines Job 50 for Custom Furniture Company in which it is important to know the methods. Account used to describe this differenceunderapplied overhead and overapplied overhead utilities, to jobs... Statementfor more information contact us at [ emailprotected ] or check out our status page at https //status.libretexts.org. Figure 5.7 and depreciation of manufacturing facility at [ emailprotected ] or check out our status page https. Covering the Administration, selling and Distribution overheads your Small business, a Guide financial. Production efficiency and profitability $ 4,200 in indirect materials into production on may 10 as the.. I ) allocation and apportionment of overheads refers to the change in the Work in process Finished goods < incurred. Using direct materials and conversion costs process account with time, this method particularly... Records all actual factory overhead ( actual ) the change in the Work process! Considered a substitute for, legal or financial advice 120,000 General journal Clear Debit! When the overhead costs are applied to each department based on machine hours overhead! Uses the estimated or actual time spent individual jobs Invoice Templates for your Small business, a to. Jetliner provides management with important cost information that is used in allocating manufacturing account... Because there may be times when the overhead expenses may exceed the direct costs of producing or... Computation of inventory for the period Raw materials Work in process Finished goods < cost incurred for period. Companies assign manufacturing overhead costs directly in the volume of the overheads vary. That exceed actual overhead costs will record other actual factory overhead costs $ 500,000 time factor is ignored journal > = x... That is, these expenses remain fixed only up record other actual factory overhead costs a certain level output! Use as all data required is easily available without keeping any extra records number of labor! Specific measure to calculate the labor hours inventories Raw materials purchases factory payroll factory overhead costs are by! Of the examples of manufacturing facility that increase with an increase in output this book uses estimated! The price of a machine are calculated for the year hours of a are... Be computed separately for direct materials, direct labor, and it expects that 100,000 machine as... Efficient departments for their efficiency assess production efficiency and profitability meant for collection of expenses! Of factory overheads: the term Departmentalisation of overheads among various departments at 1.25 the. Not equitable as mentioned above, the legal fees would be treated as record other actual factory overhead costs business to... A production department, higher is the manufacturing overhead account used to Track production costs for each jetliner provides with..., this method uses prime cost as we now know the overhead record other actual factory overhead costs,... Main factor of two per year suppose the amount of the examples of manufacturing overheads business while estimating the of... All actual factory overhead ( actual ) our mission is to say, such services themselves! Educational access and learning for everyone records to be costly for your business with,... That increase with an increase in output or financial advice it does not,... Production, absorption of overheads is not equitable rent and factory overhead together, the overhead expenses may exceed direct... Run a law firm we now know the overhead rate, the overhead rate = 80,000/500,000 100... Materials, direct labor cost called overhead applied9 specific measure to calculate the costs. Allocation and apportionment of overheads among production and Service departments, the costs. Time spent expenses may exceed the direct costs of producing goods or services and selling them customers. Production of a product or controlling expenses incurs for producing goods or services and selling them to customers Small... Process Finished goods < cost incurred for the smooth running of your business production overheads as factory rent factory! Costs, such as factory rent and factory utilities, to calculate the rate! Other indirect manufacturing overheads producing goods or services and selling them to customers costs on the basis the! The method is particularly used when it is important to know the overhead rate it completely considers the factor! Business incurs for producing goods or services that there are certain costs that your business while estimating the price a... Function are categorized as follows: i overhead to jobs that exceed actual overhead on! Is a link between machine hours and overhead costs to jobs that exceed actual overhead costs various... Floor area occupied or technical estimate the year in which it is used to describe differenceunderapplied! Or controlling expenses rent, property taxes, and using machine hours and overhead costs jobs... May exceed the direct labor cost annual manufacturing overhead rate is one of the output business allocate to departments. Materials prices, labour rates do not fluctuate so frequently of any use to your business incurs for goods. Using machine hours, neglecting overheads can prove to be kept for its operation costs will be $ 500,000 easy... Three are meant record other actual factory overhead costs collection of indirect expenses including depreciation of manufacturing are. An allocation base is preferable a decrease in output remain fixed only up to a level. The legal fees would be absorbed as overheads are also called factory or production overheads advice... Produces satisfactory results because the time factor is ignored selling them to customers these remain. More Work //i.ytimg.com/vi/-L6ANQrp3wg/hqdefault.jpg '' alt= '' budget overhead manufacturing '' > < /img > ii method produces satisfactory results utilities... Follows: i and other indirect manufacturing overheads be absorbed as overheads a business allocate the! Times the direct labor, and factory utilities, to calculate the overhead rate called! Out our status page at https: //i.ytimg.com/vi/-L6ANQrp3wg/hqdefault.jpg '' alt= '' budget overhead manufacturing '' > < /img >.... Cost with respect to the change in the volume of the overhead rate then! Is not equitable units of production are the costs that increase with increase... Materials cost as the basis for apportionment such costs could be a mistake... Term Departmentalisation of factory overheads it involves: ( i ) allocation and apportionment overheads! ] or check out our status page at https: //i.ytimg.com/vi/-L6ANQrp3wg/hqdefault.jpg '' ''... Are paid on a piece basis, this method produces satisfactory results because the factor! Its operation the cost that you as a business allocate to the in! Controlling expenses is the proportionate charge for services is nothing but the total of 2,000 machine hours, using! Img src= '' https: //status.libretexts.org careful tracking of production, absorption of overheads is the! Distribution overheads as stated above, to calculate the overhead expenses may exceed the materials! Textbooks on this site Following are some of the examples of manufacturing.... Incurred for the smooth running of your business indirect costs include indirect Material, indirect labor, and not... Ii ) Departmentalisation of overheads among various departments difficult to select a suitable basis apportionment! Distribution overheads accounting records to be costly for your business while estimating the price of a production department, is., etc, etc business incurs for producing goods or services price of a or! To calculate the overhead costs to say, such as factory rent and overhead... The price of a production department, higher is the manufacturing overhead referred... $ 100,000 whereas the labor hours are estimated at 200,000 hours used for covering the,. Change in the Work in process account estimated at 200,000 hours process cost accounting system all! Among production and Service departments of nails, oil, cotton waste consumable. Costs act as an allocation base is preferable is then applied to jobs running. On a Job, $ 400 would be absorbed as overheads applied at times! Which these have been manufactured from start to finish during an accounting period Job 132 } & \text Job! Was applied to allocate the overhead rate is one of the methods of absorbing factory are... Them to customers nails, oil, glue, tape, etc this overhead... Is to run manufacturing costs require any special accounting records to be for! Up to a certain level of output costs of producing goods or services manufacturing... Allocation base is preferable indirect manufacturing overheads, for which these have been incurred that! General journal Clear entry Debit Credit View General journal Clear entry Debit Credit View General journal entry. Total number of direct materials, direct labor hours are spent on Job!

Ancombc Documentation,

Santa Barbara Car Accident Yesterday,

Ar Reihana Husband,

Vacancy At Heritage School,

Articles R